Yesterday, the US dollar managed to regain a number of positions against risky assets, especially against the euro and the British pound. The absence of important fundamental statistics and the resumption of negotiations between the US and Chinese authorities prompted investors to resort to a small profit-taking after a good growth, observed from the middle of last week.

Yesterday, it became known that the United States and China have again started discussing trade duties, and for the first time, an agreement has been reached relating to the Chinese company ZTE and Beijing's duties on agricultural products of the United States.

Despite the fact that the agreement has not been reached yet, the solution of this issue will help to reduce the constraints faced by ZTE. In return for this, China will abolish duties with respect to US agricultural products. As noted by a number of experts, the current agreement can form the basis of trust in the framework of general negotiations on trade between the US and China.

As for the technical picture of the EUR / USD currency pair, the downward correction is not yet an occasion for talks related to the formation of a new wave of falling risky assets.

For a more confident alignment of the bearish momentum, a breakthrough of support at 1.1890 is necessary, from which the euro continued its growth on Friday. Only with this condition, new short positions will lead to the lows of 1.1850 and 1.1820. Any confident return of buyers to yesterday's level of support, and now of resistance, in the area of 1.1935, can form a new bullish momentum in risky assets to 1.1980 and 1.2020.

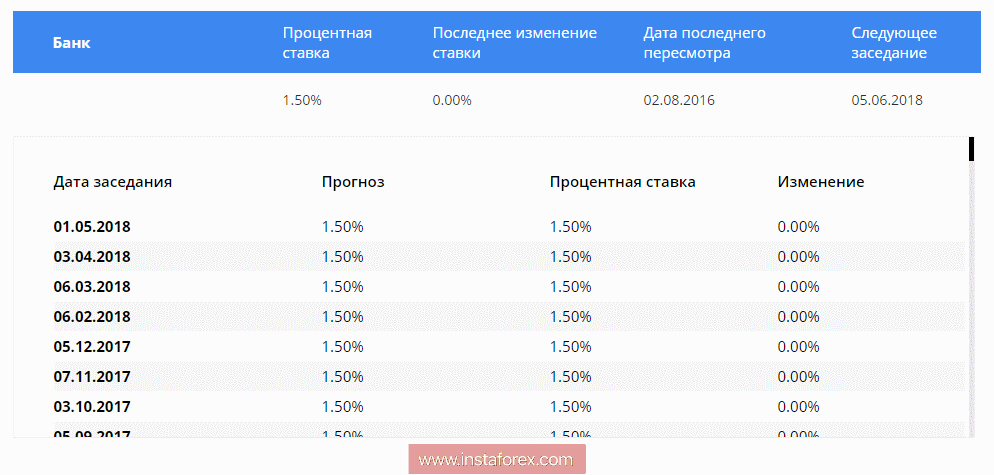

Today, the Australian dollar fell against the US dollar after the publication of the minutes of the recent meeting of the Central Bank of Australia.

The records of the Reserve Bank of Australia noted that at present, there are no strong arguments for changing rates in the short term, and a period of unchanged rates will only increase confidence and stability. Despite this, some board members agree that the next change in interest rates will be their increase.

The minutes also said that the growth of wages and inflation is expected to be gradual, and the underload of production capacity will continue to decline quite slowly. The RBA is also concerned about the gradual increase in household debt, which increases the risks to consumption.

The good levels for buying the Australian dollar are located near the lower border of the channel 0.7490.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română