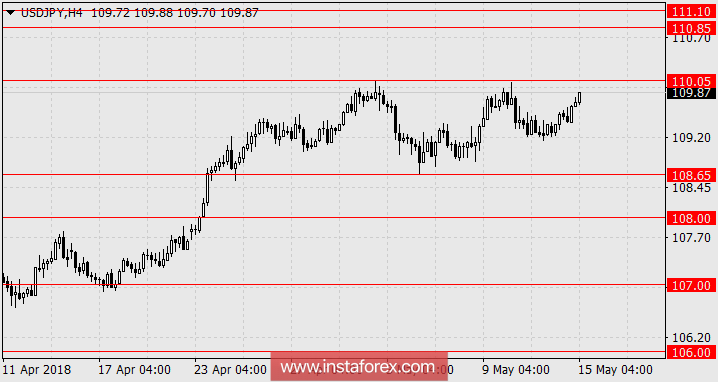

USD / JPY pair

Yesterday, the Japanese yen added 27 points due to a small strengthening of the dollar index (0.12%) and a slight increase in the US stock market (S & P500 0.09%, Dow Jones 0.27%). The strength was enough to drive investors in calmly accepting the fall in the price index for corporate goods (CGPI) estimate from 2.1% y/y to 2.0% y/y in April. However, the forecast for CGPI was exactly this. The index of business activity in the services sector decreased by 0.3% against the forecast of -0.2% in March.

In the Asian session today, mixed economic data on China exerted pressure on the markets. Industrial production in April rose from 6.0% y/y to 7.0% y/y, with expectations of 6.4% y/y, but other important indicators have spoiled the whole impression. Thus, the volume of investments in fixed assets decreased from 7.5% y/y to 7.0% y/y. Retail sales for April declined from 10.1% y/y to 9.4% y/y against expectations of a weaker decrease to 10.0% y/y. For these reasons, the Chinese stock index China A50 lost 0.62% while the Japanese Nikkei 225 -0.11%.

But the yen, despite the hitch in the stock markets, expectations for retail sales in the US are good is growing, which can change the situation and the stock market. The forecast for April Retail Sales is 0.4%. We are waiting for the yen in the range of 110.85-111.10.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română