On Friday, the US dollar stopped declining. However, its dynamics against major currencies turned out to be mixed. In general, the dollar index, reflecting its ratio to the basket of currencies, declined, demonstrating such dynamics for the second consecutive day.

As previously indicated, after the dollar rally which lasted from the end of April, the growth of the dollar stopped last week. It can be assumed that the two main reasons have had a noticeable effect on this. On one hand, it was its strong technical oversoldness, as well as the escalation of the crisis between the States and Iran. On the other hand, inconsistent data on consumer inflation became a good reason for profit taking after a protracted rally. It is likely that the dollar will continue to remain under pressure in anticipation of the outcome of the Fed meeting in June regarding interest rates. All the while, this indicates that the American regulator should expect the continuation of the process of raising interest rates at both the June and September meetings.

In accordance with the futures data on federal funds rates, it is expected that at the meeting of the Fed on June 13, the key interest rate will be increased by 0.25%, to 2.00% with a range of rates from 1.75% to 2.00%. This probability is estimated by the markets at 100%. At the same time, investors believe that at the bank's meeting on September 26, the rate will be raised by another 0.25% to 2.25%, with the current range from 2.00% to 2.25%. This probability is estimated at 73.6%.

Assessing this mood of the markets, we can assume that the depreciation of the dollar at the moment may be local, and if the fresh data on the US economy and inflation indicators return to growth, the rate of the American currency will also turn up.

Forecast of the day:

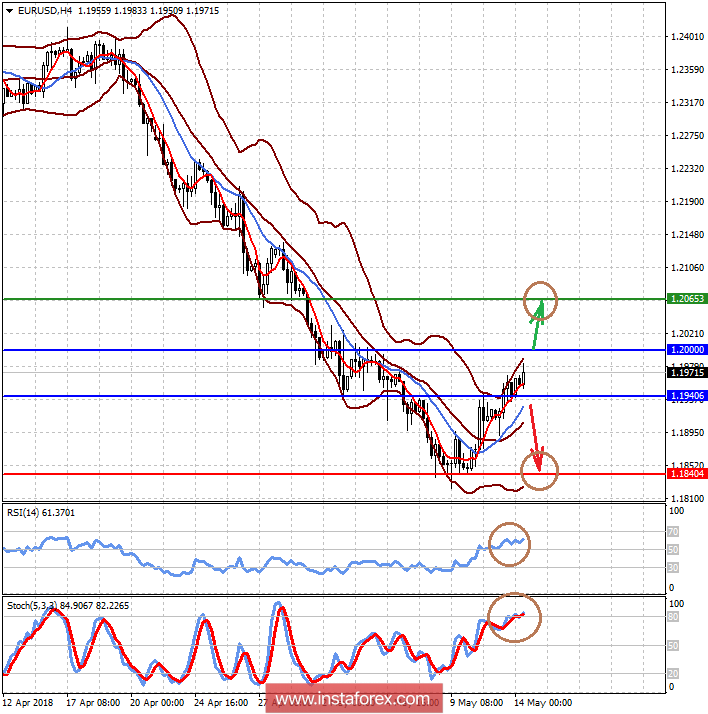

The EURUSD pair is supported by the local weakness of the dollar due to the Iranian crisis. It is likely that the pair will continue to rise to 1.2065 if it overcomes the 1.2000 mark. However, if this does not happen, there is an opportunity to turn the pair down and cause it to fall to 1.1840, if it falls below the level of 1.1940.

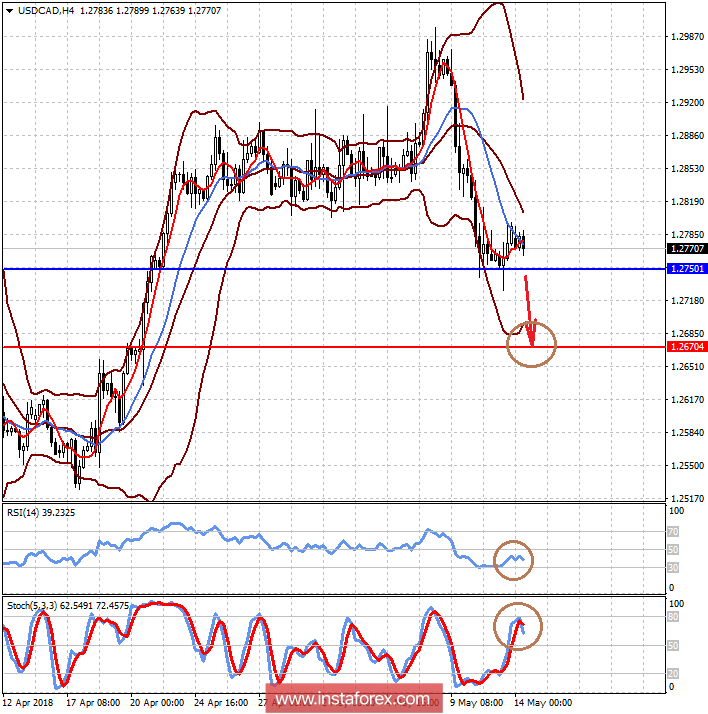

The USDCAD pair will also consolidates above the 1.2750 mark. It can resume the decline to 1.2670 if oil prices start getting support again and if consumer inflation data published in Canada this week will show recovery.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română