Eurozone

The ECB, analyzing the economic prospects of the Eurozone, notes a slight slowdown in growth since the beginning of the year. This slowdown, according to the ECB, is a consequence of several reasons. Firstly, a pullback after high growth rates in the second half of 2017 is quite logical, and secondly – the growth of risks associated with external factors, and first of all – protectionism policy.

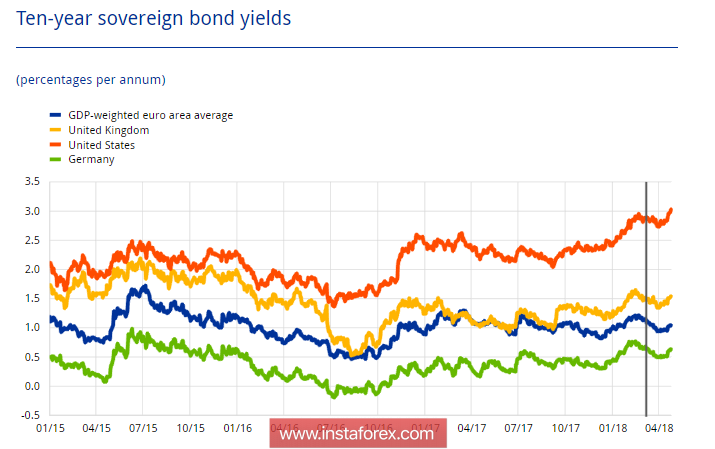

As for the assessment of key parameters, they are not in favor of the euro. The ECB assumes that the inflation rate will not exceed 1.5% by the end of the year, which means that there is a threat of an increase in the yield spread between the dollar and the euro and, as a result, a decline in the european currency.

ECB head Mario Draghi, speaking at a conference in Florence, said that the Eurozone needs a new fiscal instrument to effectively deal with crises. Whether he meant something similar to the tax reform initiated by US President Trump, or just trying to outline the circle of problems for the next summit of EU leaders, Draghi never explained. The euro strengthened slightly after the comments, but there is a more prosaic reason – locking in profits after a fairly strong strengthening of the dollar before the weekend.

Most likely, the euro on Monday will be traded neutrally before the publication of important macroeconomic data. On Tuesday, there will be a preliminary assessment of the growth rate of GDP and industrial production, as well as an assessment of the economic conditions by the ZEW Institute. On Wednesday, the focus on Eurostat's report on consumer inflation, the forecasts are neutral, a possible slowdown in inflation could trigger a new wave of decline.

Overall, the euro has no reason to start a new cycle of consolidation. It is more likely for selling to resume and movement towards the first obvious target of 1.1790.

United Kingdom

The pound ended the week near a 5-month low, staying away from a deeper fall amid the negative results of the Bank of England meeting on Thursday.

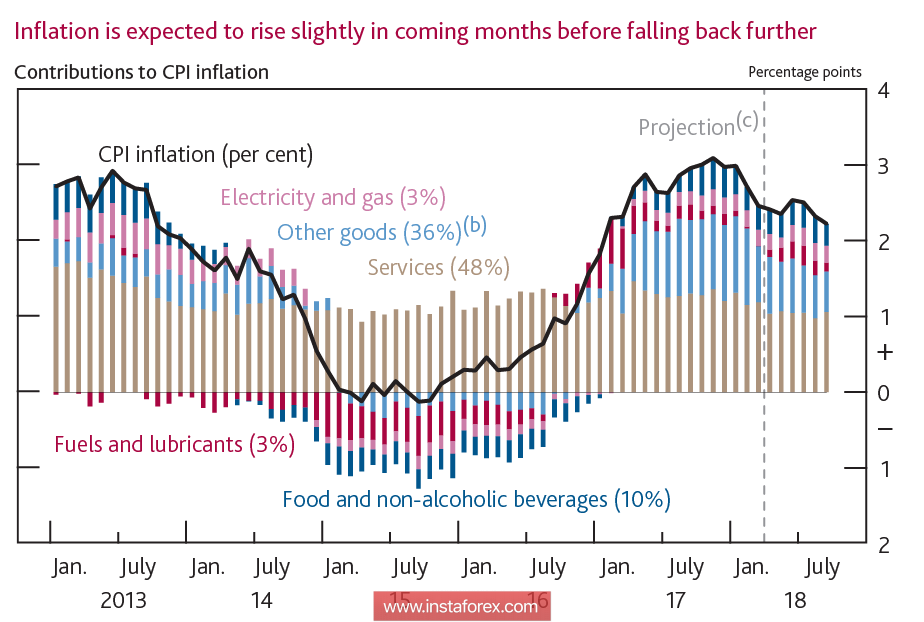

7 out of 9 members of the Committee voted to maintain the rate, as there were no objective reasons for its increase. Moreover, the forecasts are revised downward – the forecast for GDP growth for the current year is reduced from 1.8% to 1.4%, for 2019 and 2020 the forecast is maintained at 1.7%, besides the Bank of England expects a faster slowdown in inflation to 2% than previously expected.

At the moment, the UK economy shows the weakest growth in the last 6 years, so the rate hike could trigger a recession.

At a press conference, Mark Carney tried to add optimistic notes, saying that the current dovish mood is temporary and personally he still expects two rate hikes in the next year and a half. In his opinion, withdrawal from the EU creates difficulties for the economy, because it is not clear how it will function after the transition period, but the labor market looks confident, and therefore there are no special reasons for concern.

The CFTC report showed that speculators are cutting long positions in the pound, focusing on the fact that the dollar will show more convincing results in the coming weeks.

The pound is likely to start the week with selling. On Tuesday, the labor market report will be published, the most attention will be directed to the growth rate of average wages, the forecast is optimistic, if it is justified, the pound will be able to recoup part of its losses. Also on Tuesday, a hearing of the inflation report in Parliament will begin, which may result in a political show, as it will give the opposition a chance to use the weak results to attack the government.

Corrective growth is limited by the level of 1.3650, more likely the resumption of a decline, a target of 1.32 by the end of the week.

Oil

Oil prices stabilized by Friday evening, having played a negative, connected with the withdrawal of the US from the deal on Iran. While the position of OPEC + is unclear, which can be corrected taking into account new circumstances, however, in any case it is not necessary to expect a decline in oil prices, oil will continue to grow, the target is 81.50 in the near future. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română