The British "super-Thursday" had a relatively weak impact on the pound. The GBP/USD pair is still under pressure, but the bears could not carry out a assault by moving the currency to the next price range. In general, the pound yesterday has sustained a very powerful blow, having fallen paired with the dollar by only 150 points from the daily high. In general, the pair remained in the former price range, despite the negative inflationary report, the soft position of the Bank of England and the "dovish" comments of Mark Carney.

It should be noted that even at the beginning of this year, investors did not have much hope of accelerating the rate of tightening of monetary policy in Britain. Most experts said that the regulator will decide to raise rates not earlier than August (and most likely in November), after which it will take a pause for at least one year. However, at the end of winter, the head of the Bank of England surprised the market with an unexpectedly aggressive rhetoric. He positively assessed the dynamics of key economic indicators, adding that the rate can be raised "earlier than many believe."

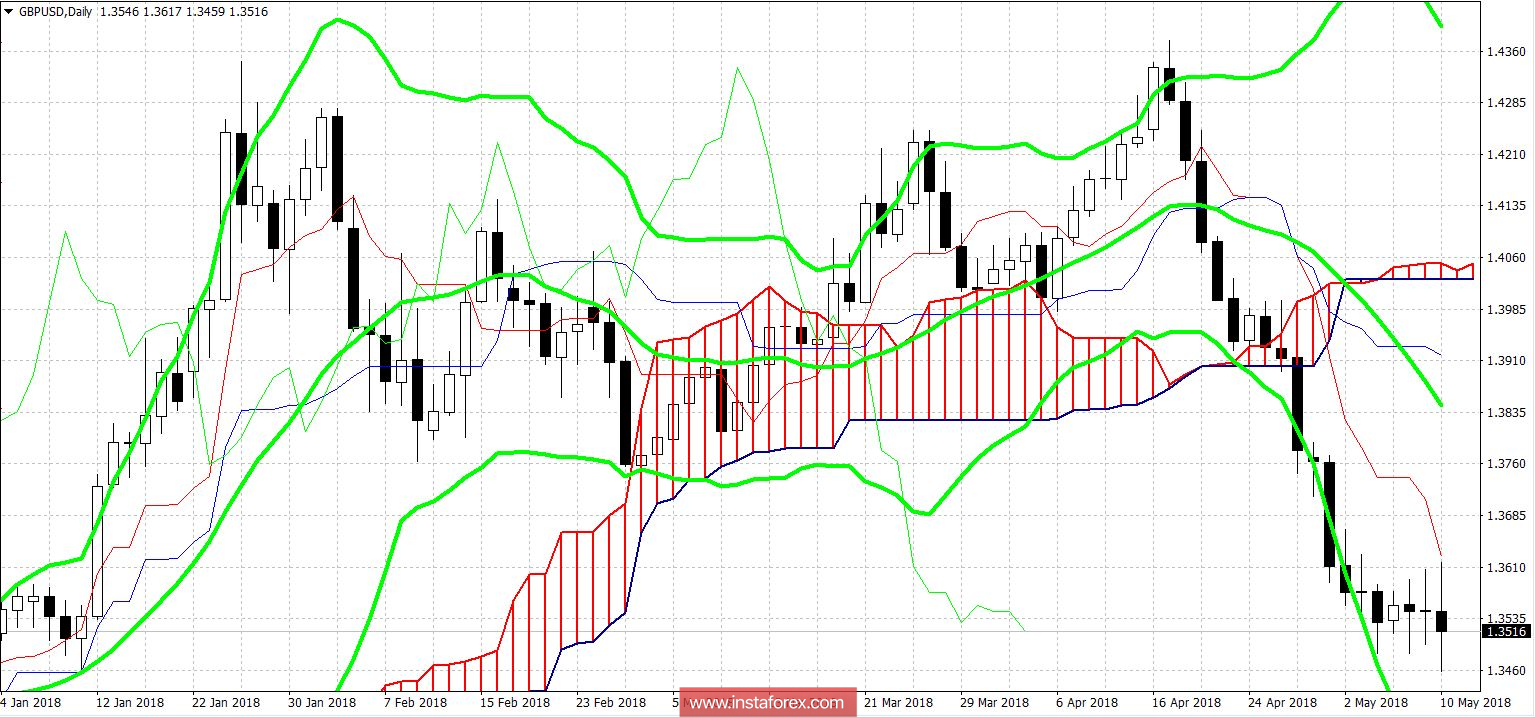

At that time, inflation was at its peak, exceeding the target level, so traders interpreted Carney's words as an announcement of a rate hike already at the May meeting. Other members of the regulator veiledly did not exclude such a scenario, so the pound, paired with the dollar, grew steadily, reaching the middle of the 43rd figure in early April. But this price peak turned out to be the summit, because already in the middle of last month the pair practically retreated downwardly. For several weeks, the price has overcome almost a thousand points, being at current levels.

I have repeatedly talked about the reasons for this dynamic. The pound rose in price against the background of rising inflation, which, in turn, grew thanks to the cheapness of the pound. But such an algorithm has a short shelf life: once the British pound is strong, inflation naturally slows down. The circle was closed, and even the growth of the oil market could not keep the consumer price index at its previous heights. In addition, due to difficult weather conditions in February-March, the main PMI indices of Britain fell significantly, negatively affecting the growth of the country's GDP in the first quarter of this year. Plus, on the eve of the June EU summit, the issue of Brexit again became acute: London and Brussels met in a regular clinch about the Irish borders and conditions of coexistence during the transition period.

In such conditions, it was difficult to expect from the Bank of England any "hawkish" notes, and even more so the rate increase. Therefore, today's negative was very predictable, especially after previous verbal interventions by Mark Carney.

However, nothing catastrophic happened yesterday. The regulator decided to take "extra time" to monitor the main indicators, but did not abandon the idea of raising the rate within this year. And since the market does not expect the English regulator to accelerate the pace of tightening monetary policy (unlike the Fed), it is largely unimportant whether the rate will be raised in May or in August - in any case, then a one-year pause will follow.

It should be noted that at the moment the British inflation exceeds the target level - according to the updated forecasts, the figure will return to 2% only in the next two years. Therefore, the regulator may not look back on the temporary deceleration of the CPI, continuing the course of normalizing monetary policy. In addition, a significant increase in the oil market and a reduction in the pound's price across the entire market will not pass without a trace: in mid-summer, inflation may return to a steady growth, especially against a background of seasonal influx of tourists. Actually, the head of the British central bank yesterday had to admit that the rate this year will not be increased only in the case of an "economic shock." However, the likelihood of realizing such a scenario is difficult to predict, especially given the recent actions of Donald Trump.

To summarize, the main conclusion of the May meeting of the Bank of England should be highlighted: the English regulator intends to raise the interest rate in 2018, despite the updated economic forecasts. This message will come to the fore already very soon, supporting the British currency. Yesterday's market reaction was of emotional nature, as traders did not see any "hawkish" surprises. But soon the emotions will come to naught, after which the market will begin to discuss another question: will the rate be increased in August or in the fall? And if inflation really returns to growth, traders will have an excellent reason to "approximate" the hypothetical date of tightening credit policy.

Bulls and bears of the GBP/USD pair now launched an assault at the border of the 35th figure, determining the local minimum at 1.3460. This price point serves as a support level, whereas the "ceiling" of the corrective rollback is the price of 1.3620 (the Tenkan-sen line on D1). After the release of conflicting data on the growth of US inflation, bulls can again seize the initiative, allowing traders to open short-term long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română