The profit taking after the three-week US dollar rally somewhat spoiled the mood for the "bears" of the EUR/USD, however, the overall picture of the market was not particularly affected. If a month ago the key issue on Forex was how soon the bulls in the euro would begin to restore the uptrend, but now investors are wondering how deep the correction will be. After stepping out from shadow of the factor of the trade war between the United States and China, the emphasis on divergence in the monetary policy of the Fed and the ECB did its job: the USD index managed to climb to the highest levels since December.

If these driver worked for years, but ceases to work in modern conditions, then something is not being clearly seen in this case. In early 2018, the growth in yields on US Treasury bonds did not lead to a strengthening of the dollar. There were rumors on the market that it was connected with an increase in the scale of issuing debt obligations under the influence of tax reform. And buyers for these papers still need to be found. Moreover, the largest holders in the face of China and Japan could easily reduce their reserves of US bonds.

In April-May the situation changed. The market began to work as it did in late 2016, when Donald Trump was elected president of the United States. The newly-minted owner of the White House in his election program focused on tax reform and the acceleration of US GDP to a permanent 3%. These factors were considered as "bullish" for the dollar in the context of the aggressive tightening of the monetary policy of the Fed. In the second quarter of 2018, investors recalled the events of 1.5 years ago.

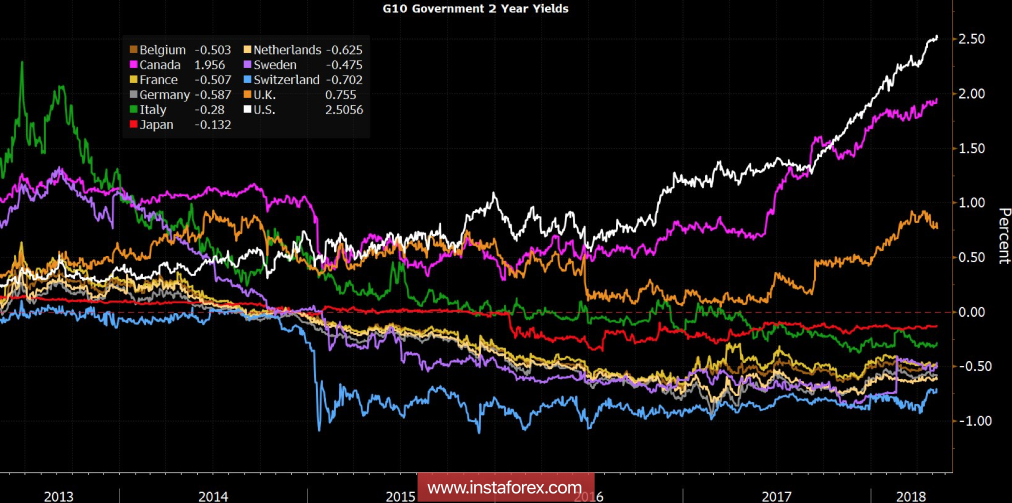

The increase in the yield of US Treasury bonds is much faster than that of its European and Japanese counterparts. A competition is made only by Canadian papers. It seems that the market still believes in the possibility of the BoC tightening monetary policy three times this year. At the same time, the slowdown in the eurozone economy, sluggish inflation and Italian political risks keep rates on European debts at about the same levels as in mid-April.

Dynamics of bond yields

From a fundamental point of view, the expansion of differentials in favor of US bonds leads to a flow of capital into the US in two main directions. First, the funding cost increases, and carry traders close their positions and return to the dollar. The value of risky assets, including currencies of developing countries, falls in the results. Second, European and Japanese investors carry money to the United States on a silver platter, seeking to capitalize on more attractive assets than at home rates. First of all, this applies to pension funds and insurance companies.

Can something drastically change the situation? I think yes. The trade conflict between the States and the Middle Kingdom can lead to a large-scale war, which will not allow the yield of 10-year Treasury bonds to gain a foothold above 3%. Recovery of the eurozone's GDP will raise rates on European debt, and a slowdown in US inflation will lower them by American counterparts.

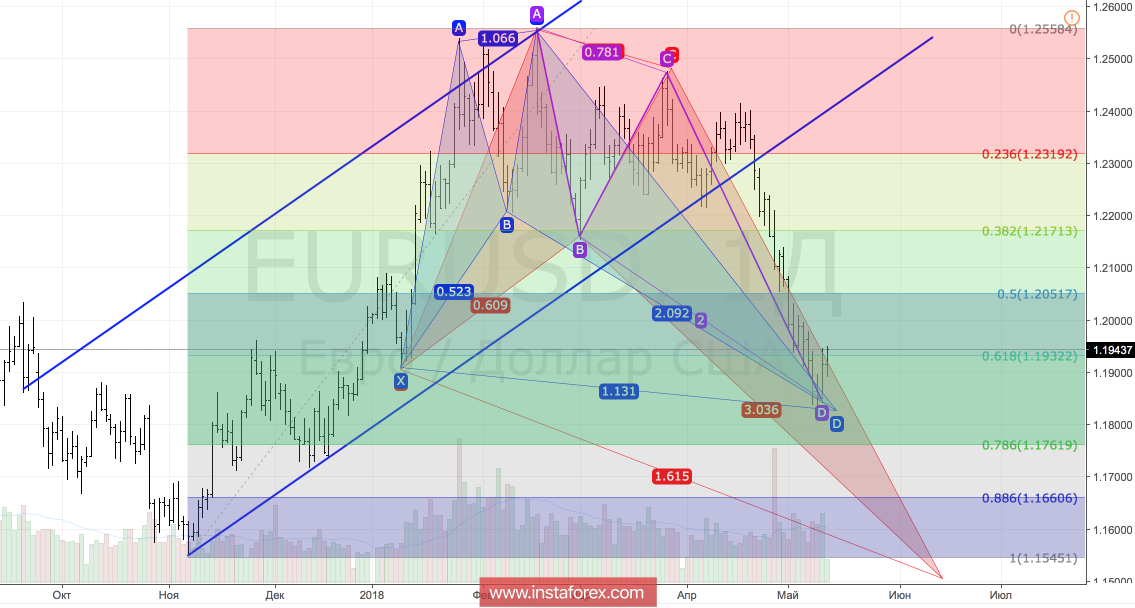

Technically, after reaching the target by 113% on the pattern of the "Shark", the correction within the framework of its transformation at 5-0 looks quite logical.

EUR/USD, daily chart

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română