The British pound collapsed today in the morning, after the Bank of England left the rate unchanged and lowered the forecast for economic growth. Despite all the statements that the economic downturn in the first quarter is not as serious as expected, it can be seen that investors are more likely to trust figures.

Comments of the head of the Bank of England Mark Carney supported the pound, not allowing him to break through the lows of the month, which would create a new downward wave.

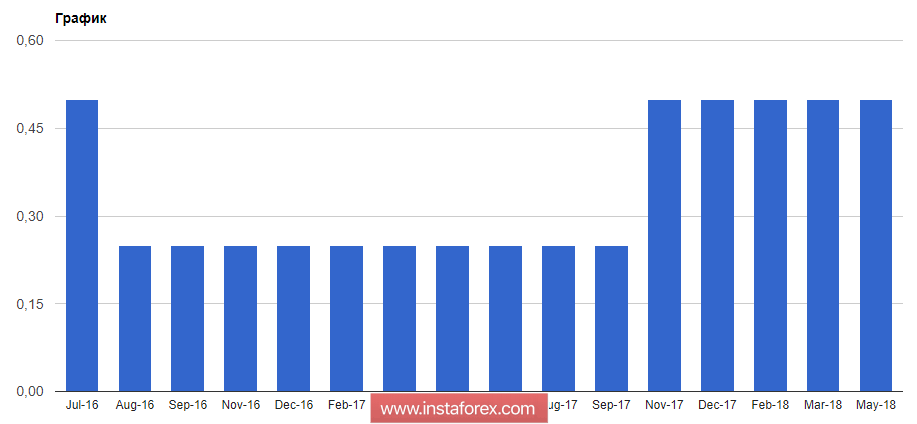

As it became known today, the Bank of England left a key interest rate at 0.5%, saying that interest rate hikes will depend on the economic situation's compliance with the forecasts. The decision to keep the key rate at the level of 0.5% was taken with the ratio of votes 7 to 2.

The Bank of England said that the prospects for the British economy remained almost unchanged, despite the unsuccessful 1st quarter of 2018, and the need to tighten monetary and credit policy remains. It is also forecasted that inflation will rise to the target level a little faster than anticipated in February this year.

According to the economists of the bank, the impact of the earlier weakening of the pound on inflation will disappear faster than expected.

The main pressure on the pound occurred when the regulator lowered the forecast for economic growth in 2018 to 1.4% from 1.8%.

During the speech of the Governor of the Bank of England, the pound received some support. Mark Carney said that the economy is stronger than the data for the first quarter suggest, and the overall economic climate, apparently, has not changed much.

In the first half of the day also published data on manufacturing in the UK, which in March this year declined. According to a report by the National Bureau of Statistics, manufacturing in the UK fell by 0.1% compared with February this year. The main reduction in production was noted in electrical equipment and pharmaceuticals.

As for the technical picture of the GBP / USD pair, much will depend on the support level of 1.3485. His breakthrough opens new lows in the 1.3430 area and 1.3370. The main goal of the sellers will be the area of 1.3300. If the buyers still manage to take the market into their own hands, then it is possible to speak about the upward correction only after returning and consolidating at the resistance level 1.3620, from which the demolition of a number of stop orders of sellers will return the pound to areas 1.3690 and 1.3760.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română