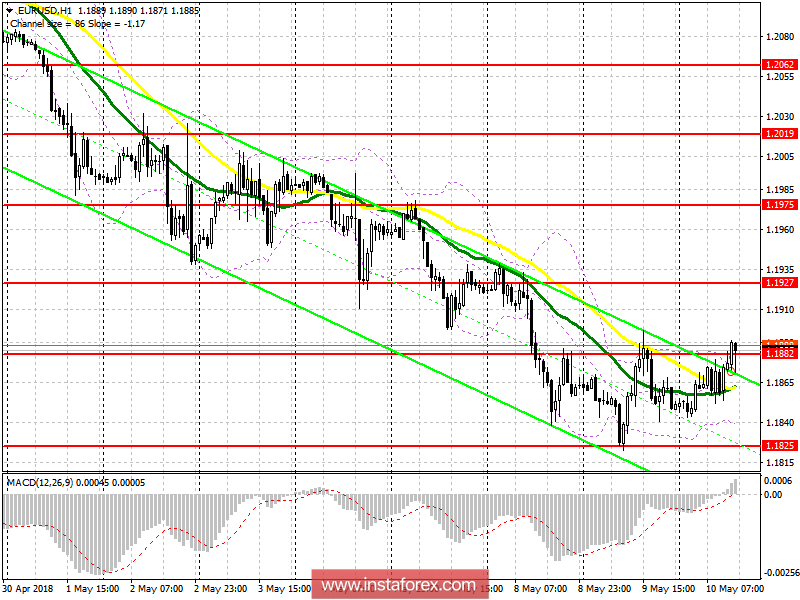

To open long positions for EUR / USD, you need:The buyers are gradually selected to the support level of 1.1882, which will allow to expect a larger upward correction to the area of 1.1927 and 1.1975, where I recommend fixing the profits. In the case of a decline in the euro in the afternoon, purchases can also be found after the support test at 1.1825 and on the rebound from 1.1792 and 1.1765.To open short positions for EUR / USD, you need:The formation of a false breakdown at the level of 1.1882 should lead to a second wave of sales of the European currency with a month low at 1.1825. If in the second half of the day there is a breach of resistance 1.1882, short positions can be returned to the rebound from the area of 1.1927 and 1.1975.

Description of indicatorsMA (average sliding) 50 days - yellowMA (average sliding) 30 days - greenMACD: fast EMA 12, slow EMA 26, SMABollinger Bands 20

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

Long-term review

Long-term review