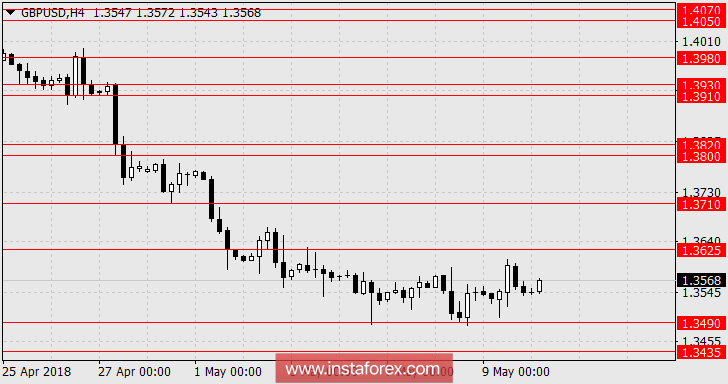

GBP / USD

Yesterday, the British pound had significantly fell by 2 points. On the other hand, there was a certain confusion about the dollar in line with the announcement of a mass political events, such as the US withdrawal from the deal on Iran's nuclear program, the preparation of the meeting of Donald Trump with Kim Jong-un in Singapore, the final straight line under the new NAFTA agreement, and disputes about the date of re-elections in Italy. With these events, the dollar index increased by 0.03%, while investors were just waiting for the meeting of the Bank of England today.

Investors do not expect changes in the rate, but they will be delighted even by the shift of votes upwards even in one voice - 3-6 against 2-7 earlier. If this does not happen, the British pound can safely continue the decline, as industrial production in the current releases does not bode optimism. Industrial Production in March could show an increase of 0.1% after the same weak growth (0.1%) in February. Production in the manufacturing industry is expected at -0.2%, and production in the construction sector is projected to fall by 2.1% after -1.6% a month earlier. The UK commodity trade balance for March is projected to deteriorate from -10.2 billion pounds to -11.2 billion pounds.

The main event is the expected fall of the pound to 1.3435. In case of the expected surprise from the Bank of England, then growth toward 1.3710 is possible.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română