To open long positions for EUR / USD, you need:

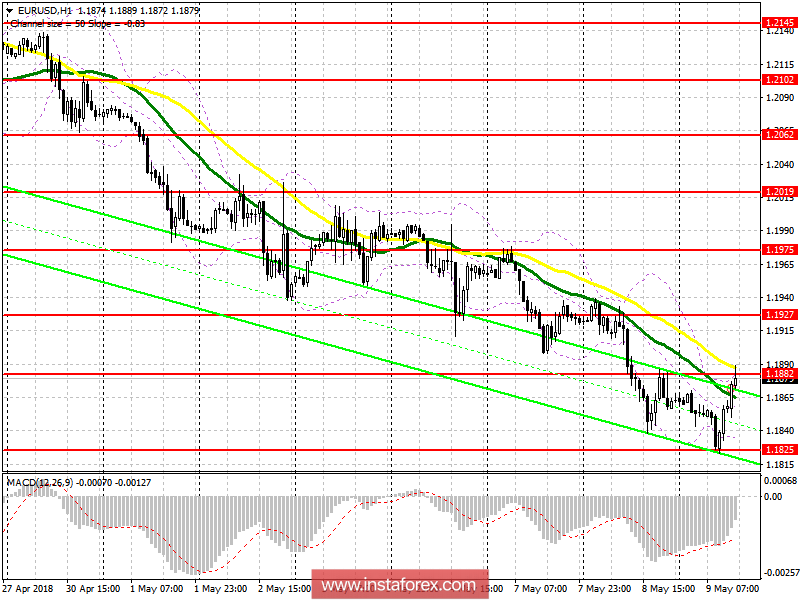

The buyers have worked out the morning divergence. Now, the next task is the breakdown and consolidation above the resistance of 1.1882, which will lead EUR / USD to the area of the larger level of 1.1927, where I recommend fixing the profit. In the case of a decline in the euro in the afternoon, purchases can again be sought from the lows of the month, around 1.1825.

To open short positions for EUR / USD, you need:

The formation of a false breakdown at the level of 1.1882 should lead to a second wave of sales of the European currency with a month low at 1.1825. If resistance breaks at 1.1882 in the afternoon, short positions can be returned to the rebound from area 1.1927.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română