Yesterday, a number of good fundamental data on the US economy had a good support for the US dollar and statements by representatives of the Fed, which are scheduled for this week, gave even more optimism to investors.

For example, a representative of the Fed, Evans, said yesterday that the regulator could continue to gradually increase interest rates, even though there is no risk of excessive acceleration of inflation. Charles Evans also voiced anxiety about the uncertainty regarding foreign trade policies, which could carry risks to the US economy.

His colleague in charge, the president of the Federal Reserve Bank of San Francisco, John Williams, also remains optimistic about the rates and growth pace of the US economy. However, Williams sees the risks for the growth of the US economy in the next few years, which are mainly tied to the foreign trade policy of the White House. First of all, according to the president of the FRS San Francisco, under the negative impact of the current policy of Trump, there will be companies and ordinary consumers. According to Williams, he expects that the GDP growth rate this year will average 2.5%.

Fed President Philadelphia Harker did not comment on the situation associated with the prospects for monetary policy, saying only that unemployment is now below the natural level, which is a good signal for the Federal Reserve System.

For today, there is a planned release of a number of important fundamental statistics for the euro area, including inflation, which may determine the further direction in the EURUSD pair at the end of the week.

As for the technical prospects, while the trade is above the lower border of the rising channel, which is currently taking place in the area of 1.2340, there is no special reason to worry about the further growth of the euro. However, its breakthrough will lead to the demolition of a number of stop orders of large buyers, which will quickly pull the euro down to levels of 1.2300 and 1.2270. In case of further growth, problems for bulls can occur at the levels of 1.2380 and 1.2420.

The Japanese yen ignored good data on Japan's export growth and continued its decline against the US dollar.

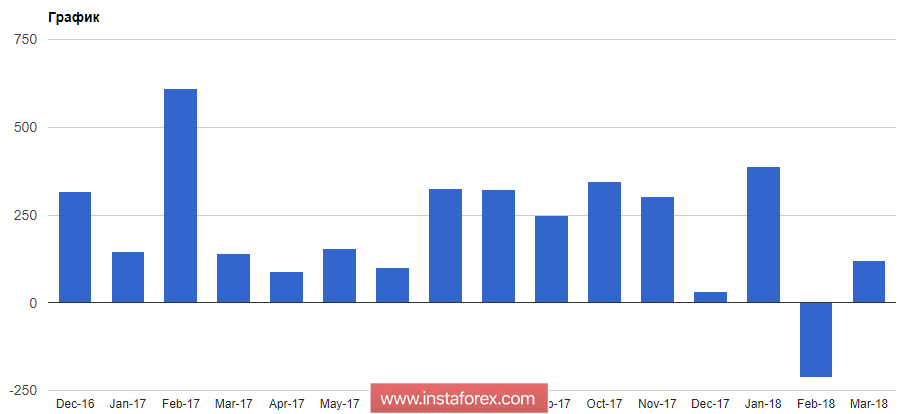

According to the report of the Ministry of Finance, Japan's exports in March 2018 grew as a result of good foreign demand, mainly for cars and equipment. Thus, exports increased by 2.1% compared to the same period of the previous year, while economists forecast a larger increase of 4.9%. Japan's foreign trade surplus in March amounted to 797.3 billion yen against 440 billion yen from economists predicted.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română