The data in the first half of the day had a negative impact on the exchange rate of the European currency, as it indicated a fall in industrial production in the euro area in February this year compared with January. The minutes of the meeting of the European Central Bank were also not optimistic.

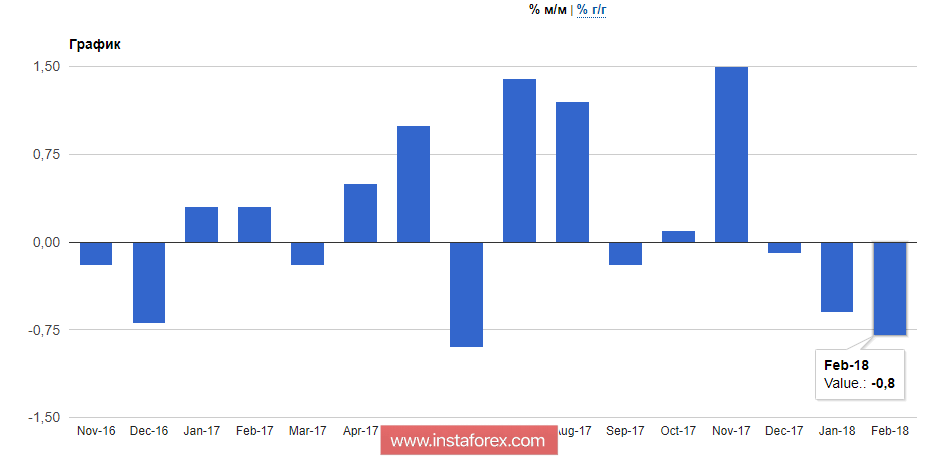

According to the report of the statistical agency, industrial production in the eurozone in February this year fell by 0.8% compared with January, while economists expected production growth of 0.2%.

Such a sharp reduction will necessarily lead to a slowdown in the growth of the euro area economy in the first quarter of this year. A declining trend is observed for the third month in a row, and each time it is bigger and bigger. Thus, in December, compared with November, industrial production fell by 0.1%, and in January compared with December by 0.6%.

As I noted above, the publication of the minutes of the meeting of the Governing Council of ECB officials, which was held on March 7-8, put pressure on risky assets, which led to a sharp decline in the European currency.

The main reason for such a sharp decline was the ECB's concern over the probability of a trade war with the US, as well as the excessively high euro exchange rate. As noted in the minutes, much emphasis is put on what will be the damage from the trade war, as well as on what measures the European Union will take, which may affect the weakening of investor confidence.

After such a report, one can hardly rely on the regulator to reduce its fiscal incentives in autumn, and especially an increase in interest rates by the European Central Bank in the spring of next year.

As for the technical picture of the EURUSD pair, the development of the market went in accordance to a bearish scenario. Now sellers are working out support levels in the area of 1.2330, continuing to strive for a larger area of 1.2300 and 1.2275.

The British pound strengthened somewhat against the US dollar after a slight decline in the first half of the day. The pound was supported by a speech by David Davis, who is in charge of the UK government for Brexit talks.

According to Davis, at the present time there is a very low probability that the UK and the EU will not reach an agreement on Brexit, and during the transition period, little will change for business. The transition period will give the UK time to prepare for the application of the new rules

Davis also drew attention to the fact that the big plus of Brexit is the ability to independently conclude trade agreements, which in the future will enable the UK to conclude more favorable agreements.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română