Eurozone

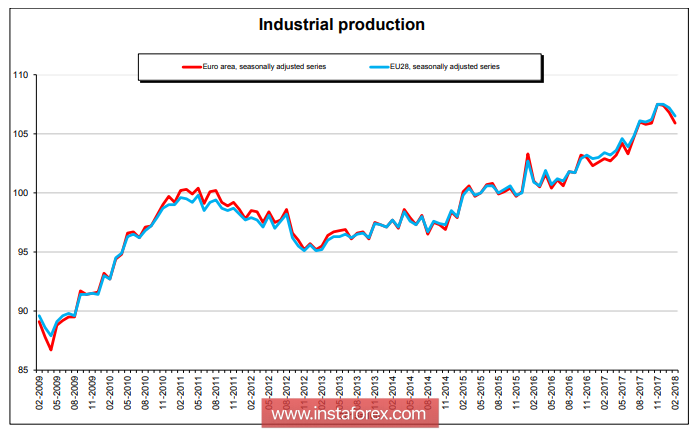

The euro area continues to publish indicators indicating a gradual slowdown in growth. Industrial production in February fell by 0.8% compared to January, year on year growth was 2.9%, both indicators were significantly lower than forecasts.

On Monday, the Sentix group published the result of the next investor confidence survey, the indicator for the second consecutive month declined significantly, showing 19.6p against 24p. a month earlier and 31.9p in February. The Sentix indicator fully confirms other studies, which indicate a slowdown in economic activity. This slowdown has nothing to do with the policy of the ECB, which skillfully avoids curtailing the incentive program.

The euro continues to confidently hold against the dollar near the high at the beginning of the year, the probability of testing resistance 1.2475 remains high, a breakthrough to 1.2550 is possible on the results of the week.

The United Kingdom

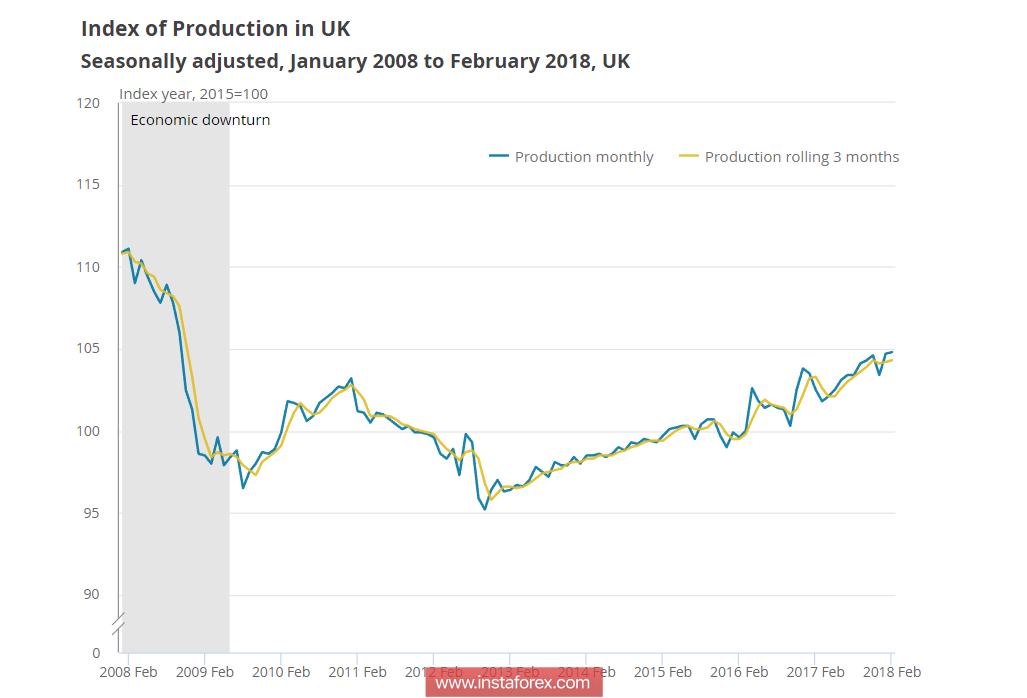

For the first time since March 2017, industrial production declined amid a fall in the output of machinery and equipment. The decrease was observed in 7 sectors out of 13, the manufacturing industry lost 0.2%, the growth as a whole was 0.1%, which turned out to be lower than expected.

The decline, however, was expected after last week Markit informed about the decline in business activity in virtually all sectors of the British economy. The National Institute for Economic and Social Research (NIESR) published its next report on GDP growth rates for the last 3 months on Wednesday, the result is + 0.2% twice lower than in the last quarter of 2017. NIESR explains the significant drop in GDP by heavy snowfalls, but the problem may lie deeper and consist in the fall in consumption due to increased import prices on the background of insufficient growth of incomes of the population.

There is growing discontent with the forthcoming exit from the EU. The CBI Group reported that, based on its research results, Brexit will lead not to profits, but to losses of British business.

The approaching trade war between the United States and China may require Britain to solidarity with a transatlantic partner, which could strike a blow to Britain's own business plans, which has recently been actively building special relations with China.

The pound is traded in a narrow range within a convergent triangle, the chances of a breakout of quotations above 1.4240 while being ironed out are weak. It is more likely that GBP / USD will decline to 1.4040 with subsequent consolidation near this level.

Oil and ruble

Brent and WTI oil prices have updated their highs since December 2014, reaching $ 73 and $ 67 per barrel on Wednesday. respectively, against the backdrop of growing geopolitical tensions. The stock report in the US was the market ignored as a minor factor in the current conditions.

There are no reasons for a fundamental nature for the growth of quotations, so the update of the highs is completely geopolitical. The further development of events will depend directly on the development of the situation in the Middle East. If the tension is removed, oil will return to the range of 65/69 dollars per barrel. The statement of the Secretary General of OPEC on reducing the level of world reserves already this year to 5-year average market values will not be taken into account as a minor factor in the current conditions.

The ruble markedly corrected on Wednesday after it became clear that the US was afraid of escalating military and economic escalation. After Donald Trump on Twitter issued a formidable promise for "new smart missiles," the dollar rose to a high of 65.06 rubles, but then this statement was actually disavowed by the US Secretary of Defense, from which it followed that the grounds for a strike on Syria is not enough. A little later, Finance Minister Mnuchin said that there would be no sanctions against Russia's sovereign debt, which actually brought the line under bearish drivers. The ruble retreated to 62.50, and, most likely, will try to return to a range below 60 rubles / dollar. and in the medium term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română