Data released yesterday in the afternoon did not significantly support the US dollar. Only some reaction to the strengthening of the US dollar occurred after the publication of the report on the growth of producer prices in the US, but then buyers of risky assets returned to the market, which preserved the upward trend in EUR / USD by the close of the day.

The report that wholesale US companies continued to replenish their reserves in February of this year passed unnoticed for the market.

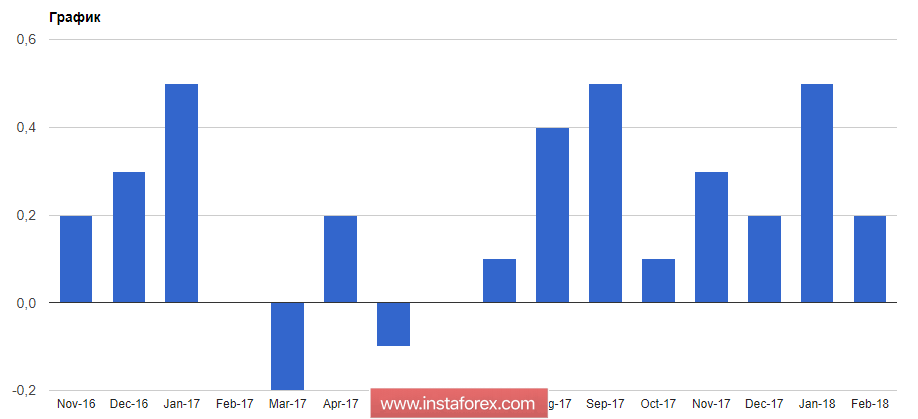

According to the US Department of Commerce, inventories in wholesale trade in February 2018 in the US increased by 1.0% compared with the previous month. Economists predicted an increase in inventories by 0.9%. Sales in wholesale trade in February also showed growth of 1.0% compared to the previous month. The ratio of stocks to sales in February fell to 1.26.

Forecasts for the growth of the French economy are revised in a more positive direction. Yesterday, a report was published in which France raised its GDP forecast for 2018 to 2% from 1.7%, which was expected earlier. Also, the forecast for economic growth for 2019 was raised to 1.9% from 1.7% earlier. As for the budget deficit, it is expected that in 2018 it will decrease to 2.3% of GDP from 2.8%, and in 2019 to 2.4% of GDP from 2.9%. Good fundamental statistics contributed to the revision of the forecast.

As for the technical picture of the EUR / USD pair, the main task of buyers of risk assets is now to break through the highs of the week in the area of 1.2380, which will allow us to count on continuing the upward trend with the renewal of new areas of resistance 1.2410 and 1.2450. In the case of good inflation data in the US, which is expected in the second half of the day, it is possible that the US dollar will be able to regain some of its positions, which will lead to a downward correction of the trading instrument in areas 1.2330 and 1.2300.

Despite the growth in oil reserves in the US, quotes continued to rise against the backdrop of the likelihood of a trade war between the US and China, as well as the escalation of the conflict in Syria.

According to the report of the American Petroleum Institute, stocks for the week of March 31 to April 6 rose by 1.8 million barrels, while gasoline stocks increased by 2 million barrels, and stocks of distillates decreased by 3.8 million barrels.

A more important report will be published today by the Energy Information Administration of the US Department of Energy. Economists expect a drop in US oil inventories by 500,000 barrels, which will support quotes.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română