GBP / JPY pair

Higher timeframes

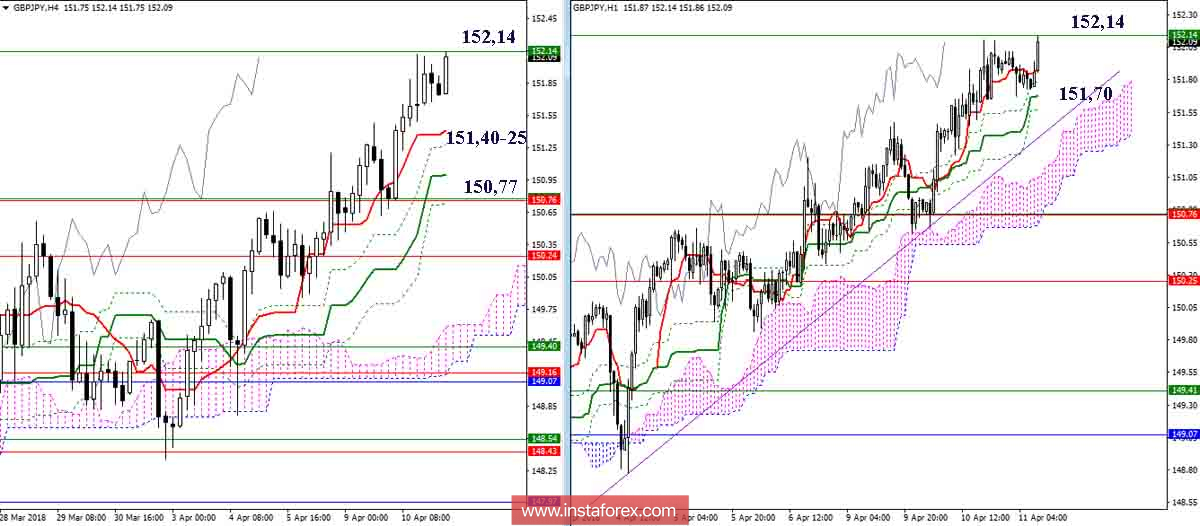

On Friday, players on the rise could not overcome the resistance of the week-long Kijun (150.77), however, they managed to close the week above the maximum extremum of the previous weekly candle. The result was the preservation and development of bullish sentiments. At the moment, historical resistance is strengthened, strengthened by the weekly Fibo Kijun (152.14). Overcoming this resistance area eliminates the week-long dead cross and allows the consideration of the landmarks in the upward target of breaking the day's cloud.

H4 - H1

Using the support of lower timeframes, the pair has reached the previously identified resistance level at 152.14. A reliable overcoming of the level opens the possibility of lifting to the following orientations in the older time intervals. Upgrade players still have an advantage, but the trend's length and the resistance encountered result in the weakening of bullish positions. so in the near future, we need to look more closely at the support. The current support is 151.70 (Kijun H1), then, it can be noted at 151.40-25 (cloud H1 + Tenkan N4 + Fibo Kijun N4), but the most important and significant in this situation is the area of 150.77. The fastening below 150.77 will eliminate the H4 gold cross, return the pair to the daytime cloud and may serve as the beginning of the formation of the rebound from the encountered resistance of the senior half.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română