Data released in the first half of the day, slightly supported the European currency, which formed a new uptrend yesterday.

Positively, euro buyers responded to the growth of industrial production in France and Italy in February of this year after more than a sharp decline in the beginning of the year.

According to the report of the statistics agency, industrial production in France in February this year grew by just 1.2% after falling 1.8% in January. Economists predicted that industrial production will grow by 1.3%.

In Italy, the indicator that was mentioned above also added 1.0% after a drop of 1.8% in January of this year. Economists were less upbeat and expected a decline in production in February by 0.5%. Compared to the same period in 2017, the industry in Italy grew by 2.5%, while economists were confident in growth of 4.8%.

The euro has grown well after weak data, which pointed to a decrease in the optimism level of the leaders of small companies in the US in March this year. It is logical to assume that the trade war unleashed by the White House administration negatively affects entrepreneurs who are expecting an improvement of the state of the economy and further develop their business.

According to the report of the National Federation of Independent Business, the optimism index of small business in March dropped to 104.7 points against 107.6 points in February. As noted in the NFIB, despite the decline in the overall index, hiring of employees and spending on the acquisition of new real estate remain at high levels.

Without attention, buyers of the US dollar left the fact that producer prices in the US in March of this year showed a significant growth, which will necessarily create a good overall inflationary pressure in the US economy, as expected by the Federal Reserve.

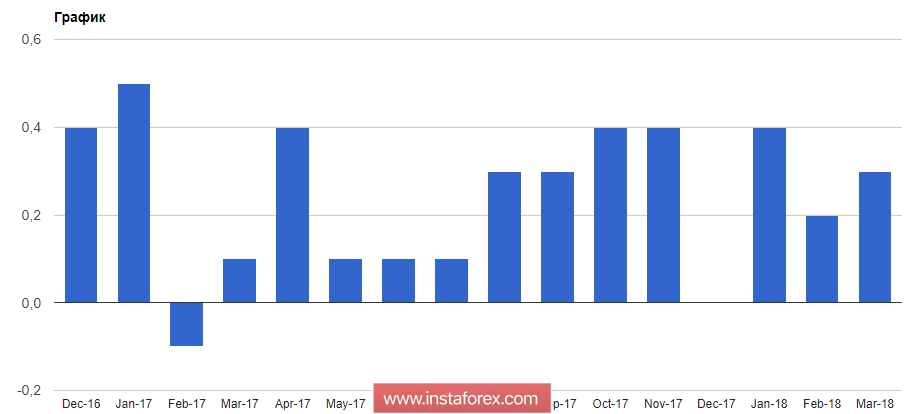

According to the US Department of Labor, the producer price index rose by 0.3% in March compared to the previous month. The tank index, which does not take into account volatile categories, especially energy prices, rose by 0.3% in March, compared with the previous month.

Economists had expected that the overall index would show an increase of 0.1%, and the base index will grow by 0.2%. Compared to the same period of the previous year, the overall index rose in March by 3.0%, the index excluding food and energy increased by 2.7%.

The British pound disregarded the speech of the representative of the Bank of England Andy Haldane, who said that monetary policy had not had a significant impact on income inequality in the UK. However, without stimulation, unemployment would be higher and GDP would be lower.

So far, demand for the pound remains on the back of a lack of new conversations related to Brexit. UK economic indicators also point to a positive scenario for the economy, which could lead to further hikes in interest rates by the Bank of England.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română