Dear colleagues.

For the currency pair Euro / Dollar, the price forms an upward potential from April 6. For the Pound / Dollar currency pair, the price forms the potential for the top of April 5, the continuation of the upward movement is expected after the breakdown of 1.4140. For the currency pair Dollar / Franc, we follow the formation of the downward structure of April 5. For the currency pair Dollar / Yen, the continuation of the upward movement is expected after the breakdown of 107.66. For the Euro / Yen currency pair, we follow the formation of the upward structure of March 22, the development of which is expected after the breakdown of 131.75. For the Pound / Yen currency pair, the continuation of the upward movement is expected after the breakdown at 151.40.

The forecast for April 10:

Analytical review of currency pairs in the scale of H1:

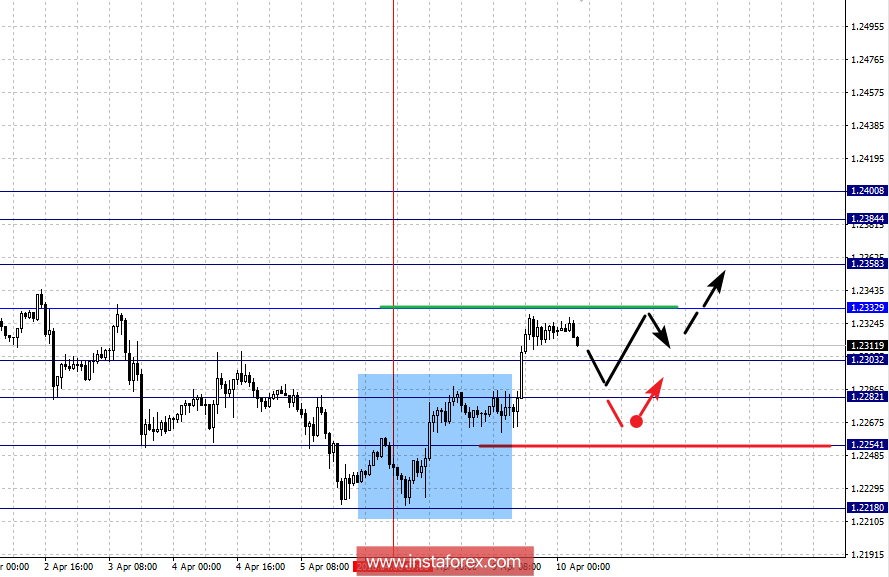

For the EUR / USD currency pair, the key levels on the scale of H1 are: 1.2400, 1.2384, 1.2358, 1.2332, 1.2303, 1.2282 and 1.2254. Here, we follow the upward structure of April 6. The continued upward movement is expected after the breakdown of 1.2332. In this case, the target is -1.2358 and near this level is the consolidation. The break of 1.2358 should be accompanied by a pronounced movement. Here, the target is 1.2384 and in the corridor of 1.2384 - 1.2400 is the consolidation, from where we expect a pullback downwards.

The short-term downward movement is expected in the corridor of 1.2303 - 1.2282 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2254 and this level is the key support for the top.

The main trend is the upward structure of April 6.

Trading recommendations:

Buy: 1.2332 Take profit: 1.2356

Buy 1.2360 Take profit: 1.2382

Sell: 1.2300 Take profit: 1.2285

Sell: 1.2280 Take profit: 1.2258

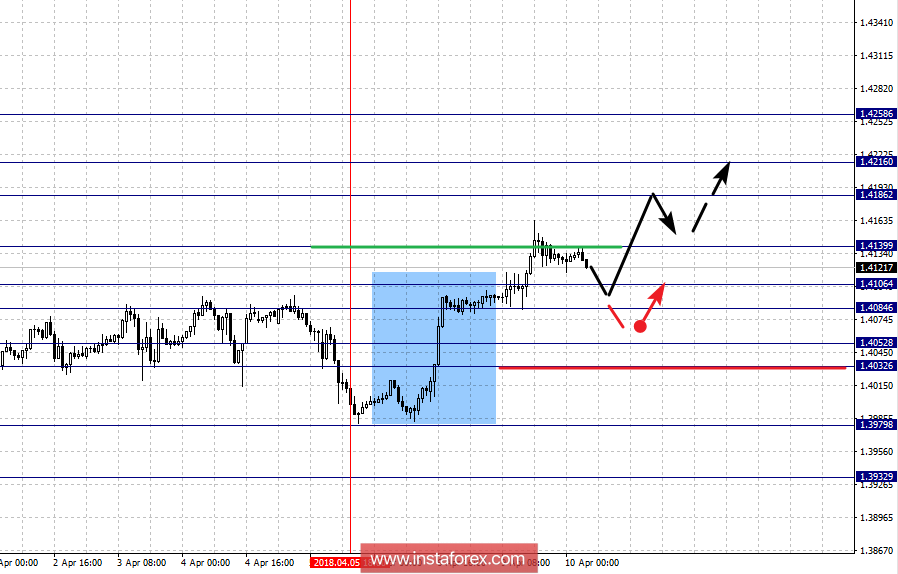

For the Pound / Dollar pair, the key levels on the scale of H1 are: 1.4258, 1.4216, 1.4186, 1.4139, 1.4106, 1.4084, 1.4052 and 1.4032. Here, we follow the formation of the local upward structure of April 5. The continued upward movement is expected after the breakdown of 1.4139. Here, the target is 1.4186 and in the corridor of 1.4186 - 1.4216 is the consolidation. The potential value for the top is the level of 1.4258, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 1.4106 - 1.4084 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.4052 and the range of 1.4052 - 1.4032 is the key support for the top. Its passage by the price will have to develop the downward structure on the scale of H1.

The main trend is the formation of the upward structure of April 5.

Trading recommendations:

Buy: 1.4140 Take profit: 1.4184

Buy: 1.4187 Take profit: 1.4114

Sell: 1.4104 Take profit: 1.4085

Sell: 1.4082 Take profit: 1.4055

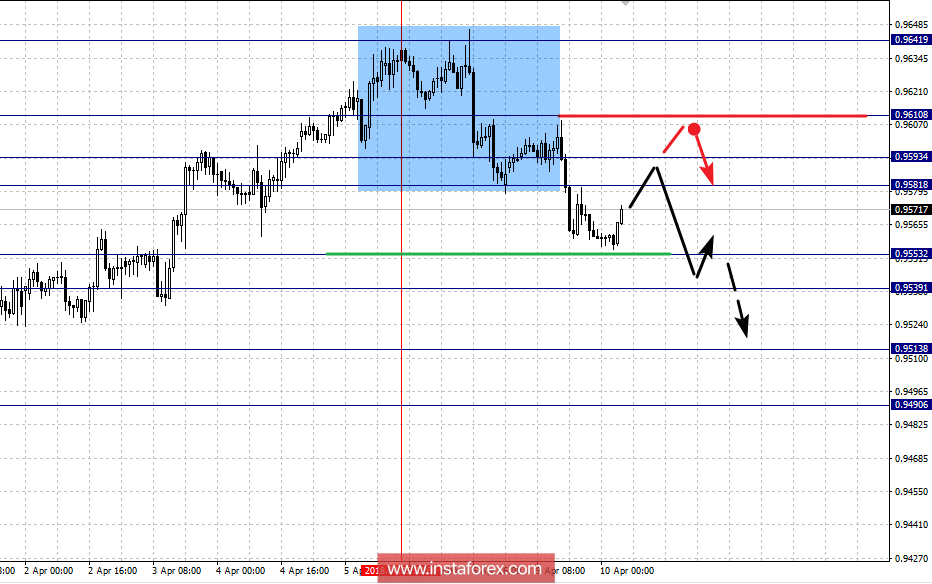

For the currency pair Dollar / Franc, the key levels in the scale of H1 are: 0.9610, 0.9593, 0.9581, 0.9553, 0.9539, 0.9513 and 0.9490. Here, we follow the formation of the downward structure of April 5. The continued downward movement is expected after the breakdown of 0.9553. In this case the target is 0.9539 and near this level is consolidation. The breakdown of 0.9537 should be accompanied by a pronounced downward movement. Here, the target is 0.9513 and near this level is the consolidation. The potential value for the downward trend is the level of 0.9490.

The short-term upward movement is possible in the corridor of 0.9581 - 0.9593 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9610 and this level is the key support for the downward structure.

The main trend is the formation of a downward structure from April 5.

Trading recommendations:

Buy: 0.9581 Take profit: 0.9590

Buy: 0.9596 Take profit: 0.9608

Sell: 0.9551 Take profit: 0.9542

Sell: 0.9537 Take profit: 0.9520

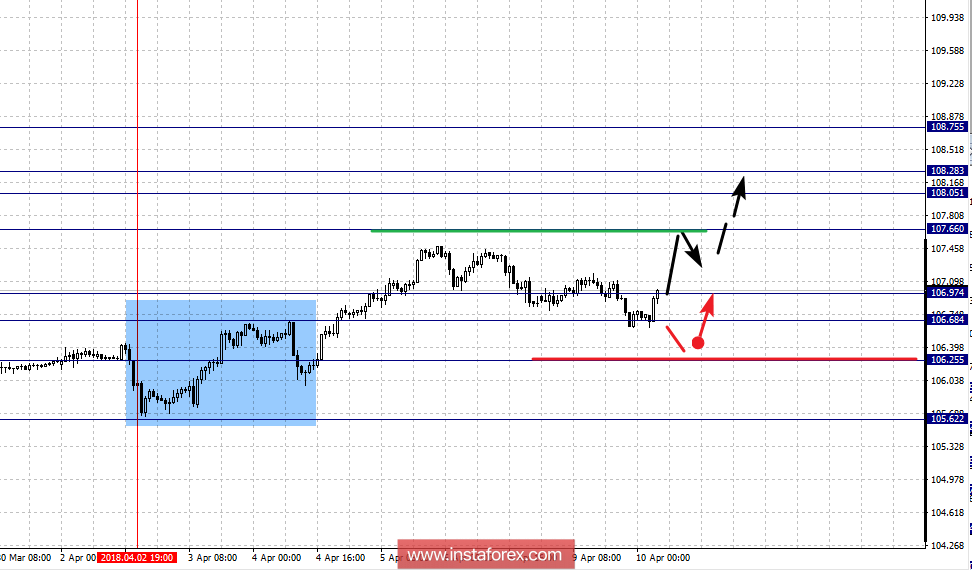

For the currency pair Dollar / Yen, the key levels on the scale of H1 are: 108.75, 108.28, 108.05, 107.66, 106.97, 106.68, 106.25 and 105.62. Here, we follow the local structure from April 2. The continued upward movement is expected after the breakdown of 107.66. In this case, the target is 108.05 and in the corridor of 108.05 - 108.28 is the consolidation. The potential value for the top is the level 108.75, from which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 106.97 - 106.68 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 106.24 and this level is the key support for the top.

The main trend is the upward cycle of March 23, the local structure of April 2.

Trading recommendations:

Buy: 107.66 Take profit: 108.05

Buy: 108.30 Take profit: 108.75

Sell: 106.95 Take profit: 106.68

Sell: 106.66 Take profit: 106.27

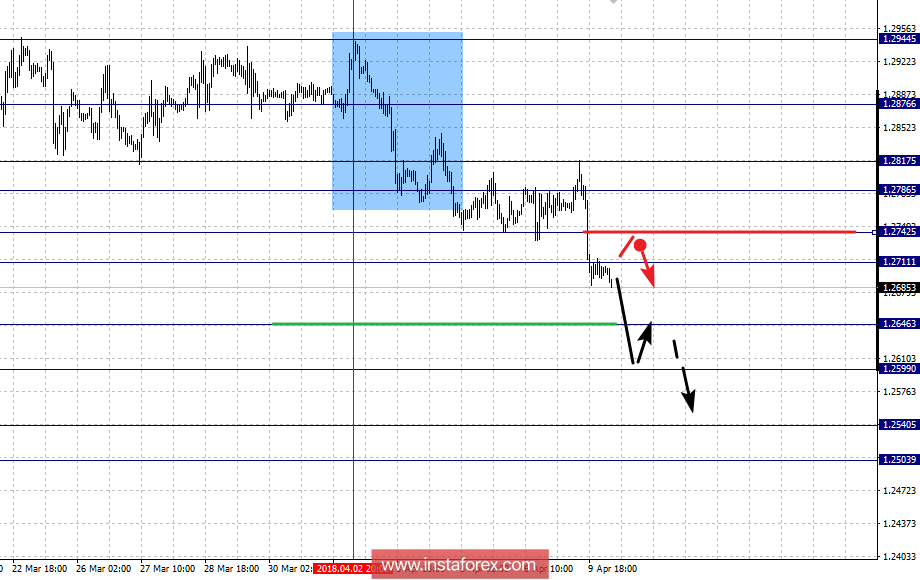

For the Canadian Dollar / Dollar currency pair, the key levels on the H1 scale are: 1.2817, 1.2786, 1.2742, 1.2711, 1.2646, 1.2599, 1.2540 and 1.2503. Here, we follow the local descending structure of April 2. At the moment, we expect the move to the level of 1.2646 and the breakdown of which will allow us to count on the move to 1.2599, near this level the consolidation. The breakdown of 1.2597 should be followed by the subsequent development of a downward trend. Here, the target is 1.2540. The potential value for the bottom is the level of 1.2503, from which we expect a rollback to the top.

The short-term upward movement is expected in the corridor of 1.2711 - 1.2742 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2786 and the range of 1.2786 - 1.2817 is the key support for the downward structure.

The main trend is the local structure for the bottom of April 2.

Trading recommendations:

Buy: 1.2711 Take profit: 1.2740

Buy: 1.2745 Take profit: 1.2782

Sell: 1.2703 Take profit: 1.2650

Sell: 1.2644 Take profit: 1.2600

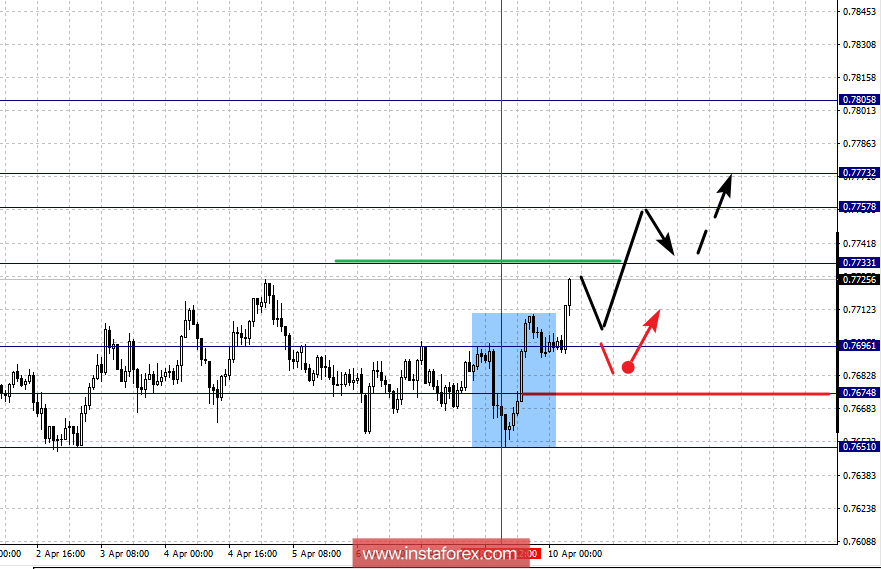

For the Australian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 0.7805, 0.7773, 0.7757, 0.7733, 0.7696, 0.7674 and 0.7651. Here on April 9, the potential for an upward movement took shape. The continued upward movement is expected after the breakdown of 0.7733. In this case, the target is 0.7757 and in the corridor of 0.7757 - 0.7773 is the consolidation. The potential value for the top is the level of 0.7805, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 0.7696 - 0.7674 and the breakdown of the last value will have to develop a downward structure. In this case, the target is 0.7651.

The main trend is the formation of the potential for the upward movement of April 9.

Trading recommendations:

Buy: 0.7735 Take profit: 0.7755

Buy: 0.7759 Take profit: 0.7770

Sell: 0.7694 Take profit: 0.7678

Sell: 0.7671 Take profit: 0.7655

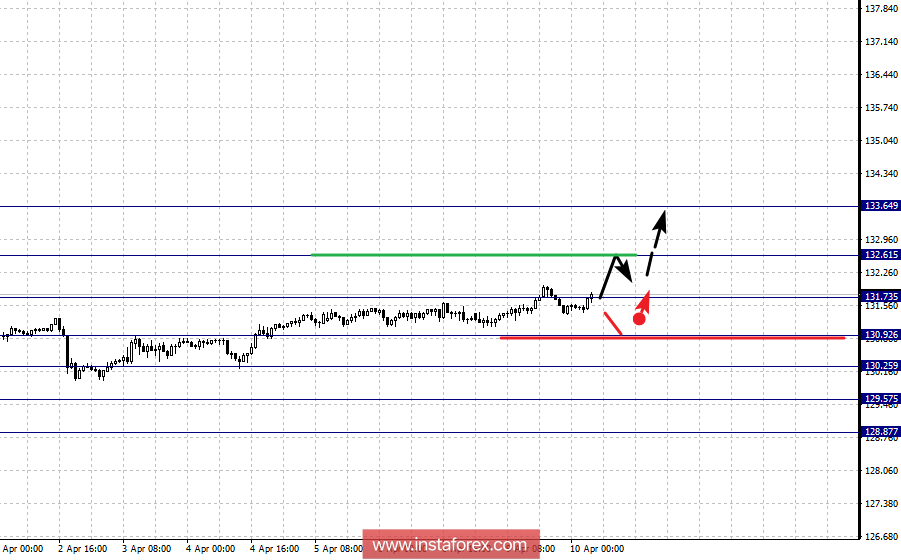

For the currency pair Euro / Yen, the key levels on the scale of H1 are: 133.64, 132.61, 131.73, 130.92, 130.25, 129.57 and 128.87. Here, we continue to follow the formation of the upward structure of March 22. The continuation of the upward movement is expected after the breakdown of 131.73. In this case, the target is 132.61, near this level of consolidation and before it we expect the formulation of pronounced initial conditions for the upward cycle. The potential value for the ascending structure so far is 133.64.

The short-term downward movement is possible in the corridor 130.92 - 130.25 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 129.57 and this level is the key support for the upward structure from March 22.

The main trend is the ascending structure of March 22.

Trading recommendations:

Buy: 131.75 Take profit: 132.60

Buy: 132.63 Take profit: 133.62

Sell: 130.90 Take profit: 130.30

Sell: 130.20 Take profit: 129.60

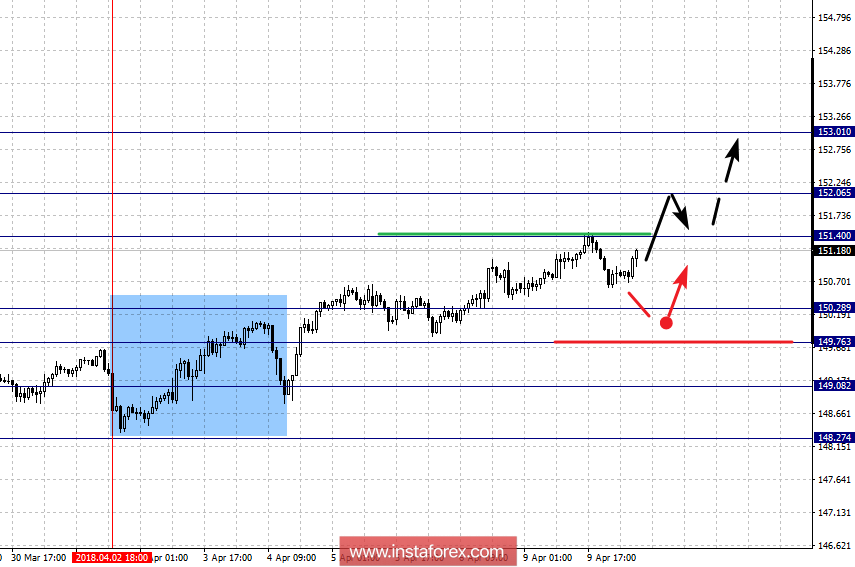

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 153.01, 152.06, 151.40, 150.28, 149.76, 149.08 and 148.27. Here, we determine the subsequent goals from the local upward structure on April 2. The continued upward movement is expected after the breakdown at 151.40. In this case, the target is 152.06 and near this level is the consolidation. The potential value for the top is the level of 153.00, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the corridor 150.28 - 149.76 and the breakdown of the last value will lead to an in-depth movement. Here, the target is 149.08 and this level is the key support for the top. Its passage at the price will have to develop a downward trend. In this case, the target is 148.27.

The main trend is the local structure for the top of April 2.

Trading recommendations:

Buy: 151.45 Take profit: 152.00

Buy: 152.08 Take profit: 153.00

Sell: 150.25 Take profit: 149.80

Sell: 149.72 Take profit: 149.10

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română