The US dollar continued to decline against the euro on Friday while a number of other currencies remain under pressure after the morning Asian session on Monday.

Weak data on the labor market led to the closure of a number of long positions in the US dollar. Moreover, the report on the decline in consumer lending further exerted pressure on the US dollar by the close of the day.

The only thing that kept the EURUSD pair from more active growth at the end of last week was the speech of Fed Chairman Jerome Powell.

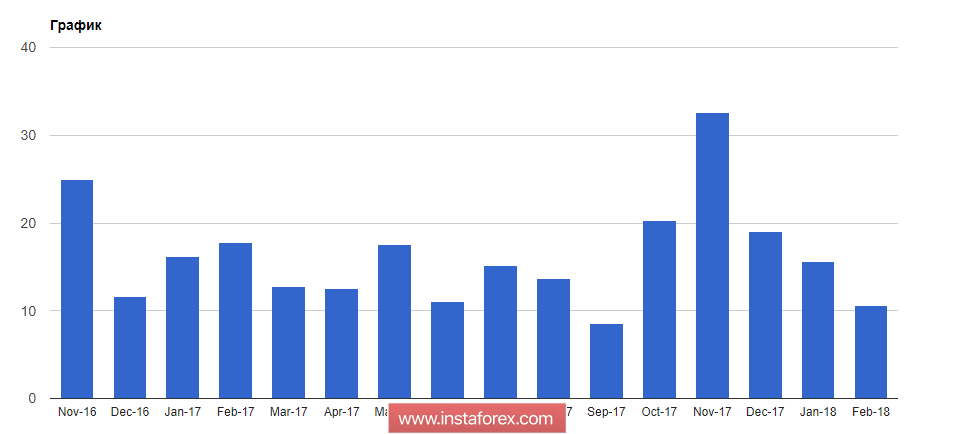

As noted above, consumer credit growth in the US slowed in February this year.

According to the report of the Federal Reserve System, consumer lending grew by only $10.60 billion compared to the previous month. Compared with the same period last year, growth was at 3.30%. It is important to note that in January, consumer lending grew by $15.59 billion. Economists had expected a loan growth of $15.1 billion.

The speech of the Chairman of the Federal Reserve, Jerome Powell, supported the US dollar. Powell said that raising interest rates contribute to a strong economy and as long as the situation in the economy continues to improve, it seems appropriate further the gradual tightening of monetary policy.

Powell also noted that the results of the polls indicate a continuation of the growth of companies' investments in connection with which, the risks for the prospects of the economy remain balanced.

As for the report on the labor market, Powell expects to achieve maximum employment in the near future. However, despite this, the chairman of the Federal Reserve stressed the need to observe signs of rising wages. The latest report from the Ministry of Labor showed a slight positive trend.

Also, inflation is expected to grow, which will take place this spring as the link between inflation and the labor market continues to persist.

As for US trade duties and protectionist measures, the new chairman of the Federal Reserve did not seriously address it, noting only that the discussion of duties is at an early stage and it is too early to say what impact they will have. As Powell expects, duties can push up prices but at present, the national debt does not have a negative impact on the prospects for US economic growth as a whole.

As for the technical picture of the EURUSD pair, much will depend now on whether the buyers will actually be able to break above the upper boundary of the descending channel, formed on April 2 of this year. If this does not happen and the trade moves below support level 1.2280, the pressure on risky assets will increase again. This will lead to the month's low at 1.2220 and then to their renewal in the areas of 1.2190 and 1.2155.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română