Prior 103.5; revised to 103.7

A slightly better reading than the previous month, which reflects some better optimism surrounding the economy. This is likely to do with vaccine optimism but we'll see how things play out as we get into the new year with the virus still rampant in the region.

The data measures the future trends of overall economic activity in the Swiss economy.

Further Development

Analyzing the current trading chart of Gold, I found that there is test of the rising line at the price of $1,878.

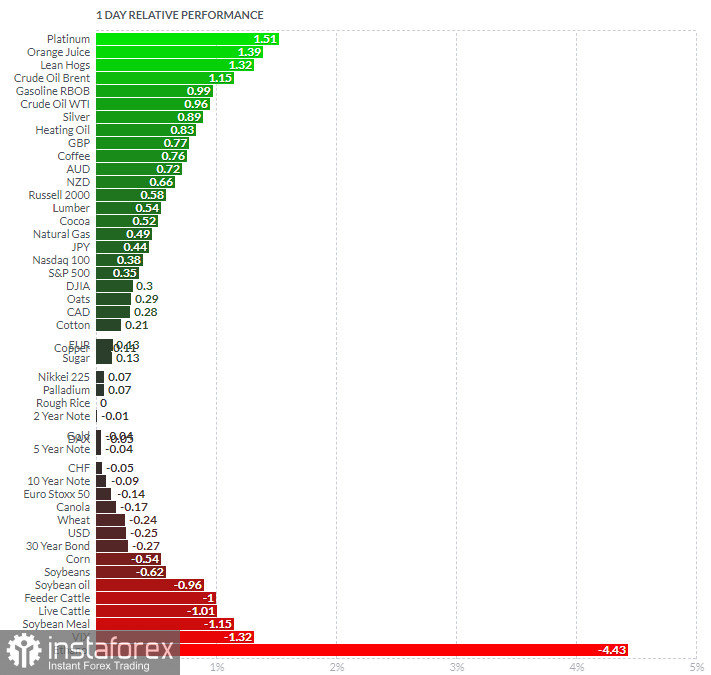

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Orange Juice today and on the bottom Ethanol and VIX.

Gold is neutral today...

Key Levels:

Resistance: $1,895

Support levels: $1,878 and $1,870

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română