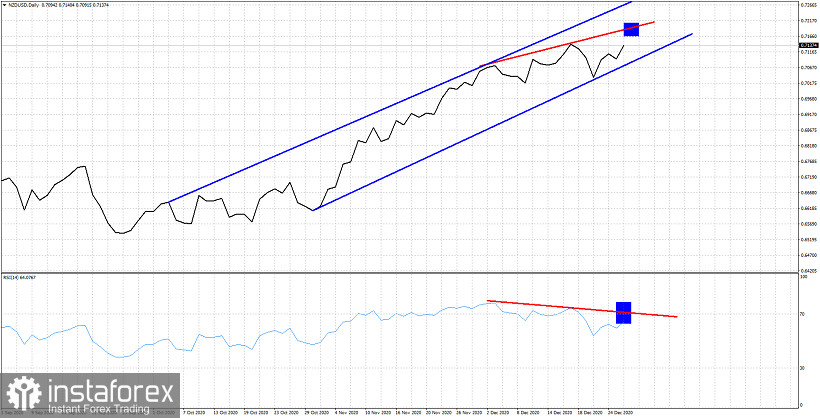

In a previous analysis we noted the bearish divergence of the RSI in NZDUSD and we explained that we prefer to be neutral if not bearish but certainly not bullish at current levels. Price pulled back a little bit but key support did not break in order to confirm the start of a pull back.

Blue rectangle- possible top

Red lines - bearish divergence

NZDUSD remains above the key support level of 0.70 and still inside the bullish channel. The bearish divergence could repeat while price makes a new higher high around 0.72 and the RSI gets rejected around the 70 level. We continue to be pessimistic for NZDUSD however there is no confirmed reversal signal yet. As we have said many times, the bearish divergence is just a warning and not a reversal signal, so traders need to plan their strategy accordingly.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română