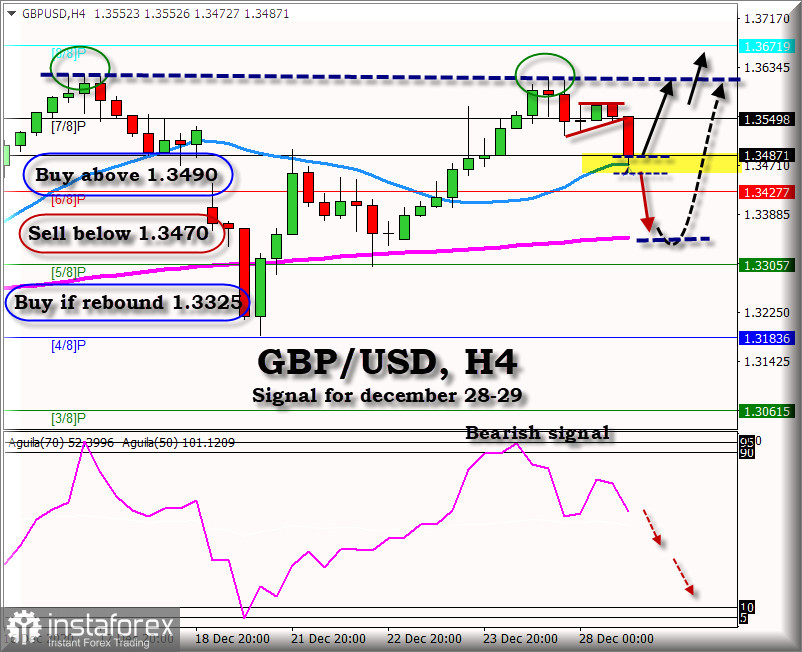

In the early US session, the GBP/USD pair is trading above the 21-day SMA, just at that level of 1.3471 where we saw a rebound of the GBP/USD pair. Now it serves as good support, and we hope that the pair may gain a new upside momentum above this zone.

Last week, the GBP/USD pair left a double top at 1.3620. Now it will have to face this level again and break through it to reach the high of the 1.3690 area of 8/8 of murray and 1.3793 +1/8 of murray.

If the GBP/USD pair trades below the 21-day SMA on the 4-hour chart, the market could push the price down to the support of 1.3325, the area of the 200 EMA. So, if we see that the pair falls below 1.3470, this will be a good selling opportunity.

Since it is the final week of the Brexit deal, we recommend buying at support levels, given that the markets expect a good bullish rally when the Brexit deal is finalized.

The market sentiment for this morning of December 28 shows that 51% of traders are selling the GBP/USD pair. This is a sign that we could expect a drop to the 1.32 area in the next few days. The eagle indicator is also showing bearish signal.

Trading tip for GBP/USD for December 28 – 29

Buy above 1.3490 (SMA 21) with take profit at 1.3549 and 1.3620, stop loss below 1.3460

Sell below 1.3470 (SMA 21), with take profit at 1.3427 (6/8) and 1.3325, stop loss above 1.3505.

Buy if the price rebounds at 1.3325 (EMA 200), with take profit 1.3427 and 1.3670, stop loss below 1.3290.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română