Latest data from the Mortgage Bankers Association for the week ending 18 December 2020

- Prior +1.1%

- Market index 863.9 vs 857.3 prior

- Purchase index 316.3 vs 331.6 prior

- Refinancing index 4,169.0 vs 4,014.5 prior

- 30-year mortgage rate 2.86% vs 2.85% prior

Purchases activity were seen cooling off with refinancing being the one bolstering mortgage activity in the past week. The housing market continues to keep in a solid position throughout the virus crisis and is staying that way through to the year-end.

Further Development

Analyzing the current trading chart of Gold, I found that there is the test of the rising trend line, which can be the good place to watch for buying opportunities. The level at $1,860.

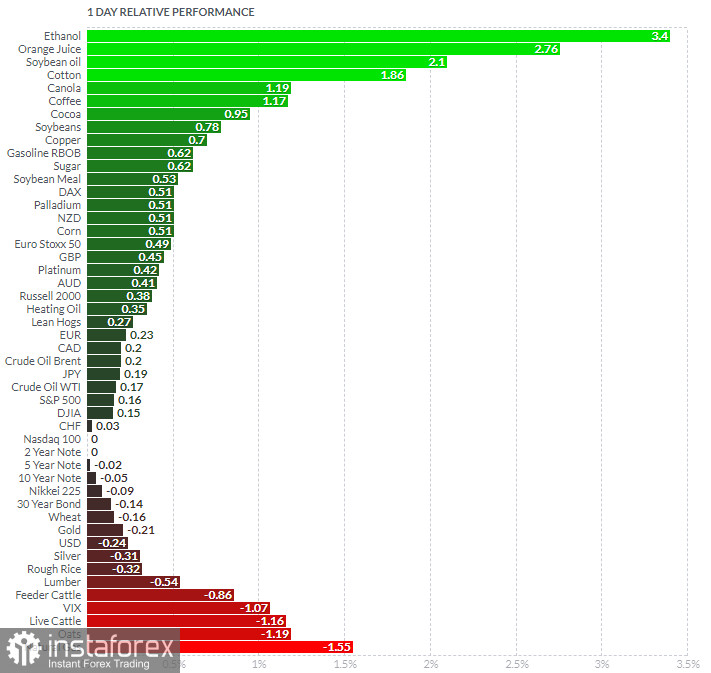

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Orange Juice today and on the bottom Natural Gas and Oats.

Key Levels:

Resistances: $$1,884 and $1,906

Support levels: $1,860 and $1,855

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română