Prior -6.7; revised to -6.8

German consumer morale eases for a third consecutive month into January as tighter restrictions weigh on sentiment, reducing income expectations and increasing the propensity among households to save more into the new year.

The headline reading is the lowest since July with GfK noting that:

"At present, the savings indicator is the main factor driving the third decline in a row in the consumer climate."

Further Development

Analyzing the current trading chart of Gold, I found that there was the selling climax from yesterday and successful test on lower volume, which is sign for the further rise.

My advice is to wattch for buying opportunities with the upside targets at $1,905 and $1,953.

Additionally, there is the rising trendline, which is still active....

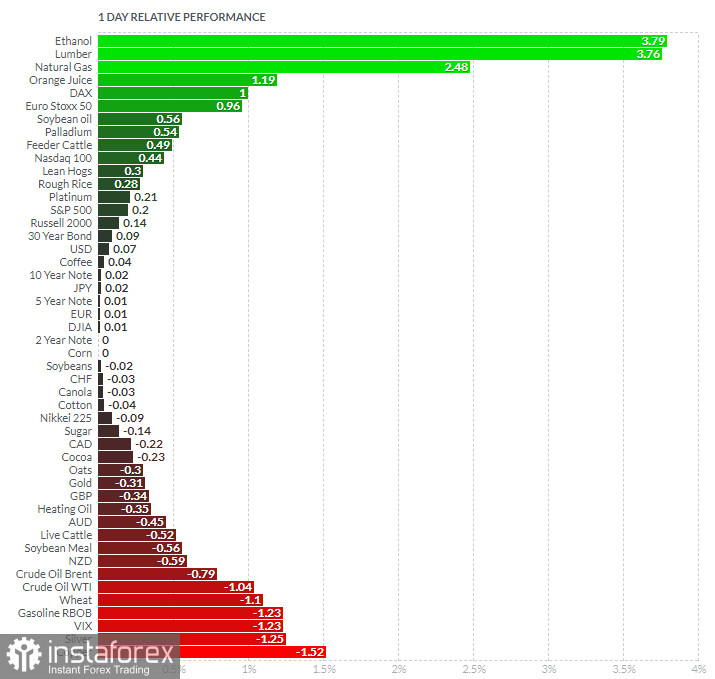

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Lumber today and on the bottom VIX and Copper.

Key Levels:

Resistance: $1,905 and $1,953.

Support level: $1,855

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română