- USD/CAD has shown oversold signals. From where to buy it again?

The pair moves in a narrow range in the short term indicating exhausted sellers. Technically, the pair has shown some bullish reversal signals but is still premature to talk about a bullish reversal as long USD/CAD is traded under the immediate downtrend line.

USD/CAD seems undecided in the short term, the US and Canadian high impact data failed to bring a clear direction or to add high volatility. I still hope that the Canadian retail sales data could bring life on this pair later today.

Retail Sales and the Core Retail Sales are expected to increase by 0.1%. Better than expected data, a higher growth, could send the rate down again, while in line with expectations figures, or worse could boost the price.

USD/CAD Seems Oversold!

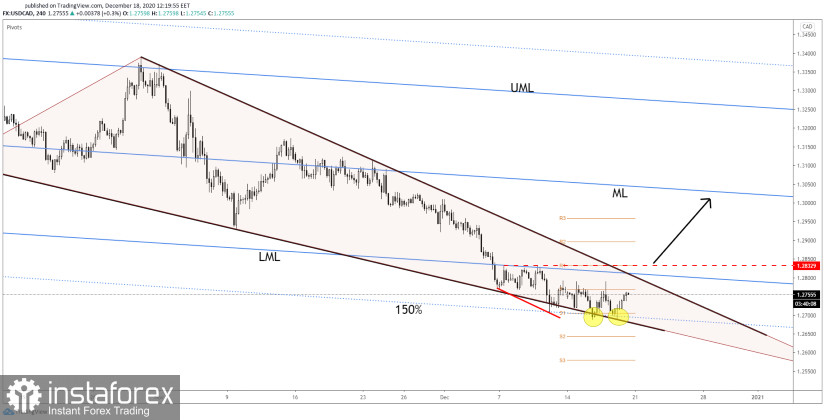

USD/CAD has tested and retested the Falling Wedge's downside line and the 150% Fibonacci line of the descending pitchfork and now has turned to the upside again. Breaking from this reversal pattern could bring a great long opportunity.

Personally, I believe that a valid breakout somewhere above 1.2832 suggests buying again as USD/CAD could advance higher in the upcoming period. You should be careful because a false breakout with great separation above the black downtrend line or above the R1 (1.2832) indicates a new bearish momentum.

- USD/CAD Trading Conclusion!

Buying Signal - a bullish closure above the R1 (1.2832) could validate the Falling Wedge and confirms further growth towards the 1.3000 psychological level. A larger upwards movement could be announced by a valid breakout above the median line (ML) of the major descending pitchfork.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română