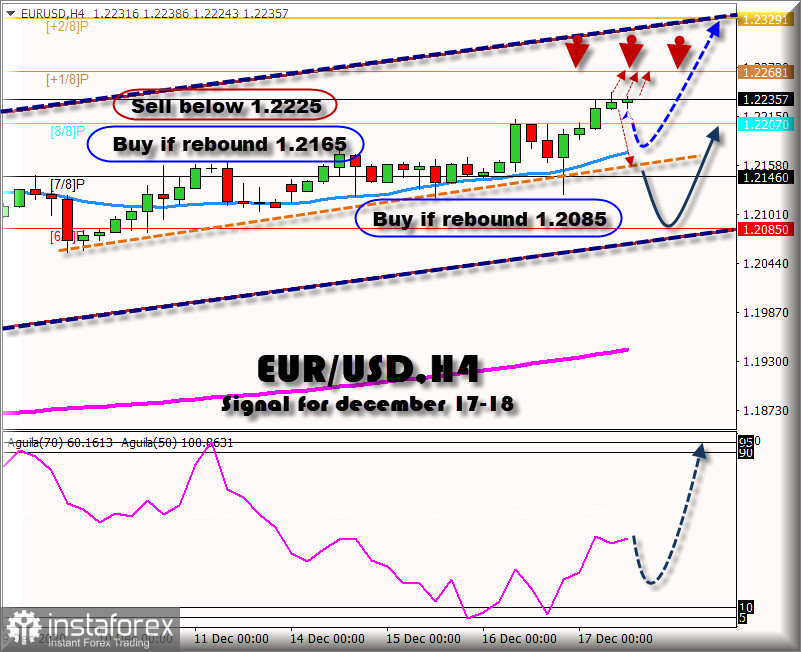

The EUR/USD pair in this American session is trading above the 8/8 Murray and above the 21 SMA. The latest 4-hour candles show that there is an exhaustion, and the pair will most likely face resistance of 1.2268, where the (+1/8 of murray overbought zone) is located. If this level is reached, a downward correction of the pair will be imminent.

On the other hand, the weakness of the USDX for the next few days could cause the euro to take upward momentum to the 1.2329 zone, because in Washington the legislators are on track to sign a package of 900 billion dollars. If this relief package is provided, we could see a fall in the US dollar and a bullish momentum of EUR/USD in the next few days.

On the technical level, in 4-hour charts we note that EUR/USD is trading under strong buying pressure, supported by the eagle indicator that is showing a bullish signal. However, the first resistance is found at 1.2268, this level is key below this zone. We could see a downward correction to the support of the 21 SMA at 1.2165.

If the pair bounces off the 21 SMA, we can buy the euro again with 1.2329 targets, as the correction will give the market more bullish momentum.

The sentiment of the market for this morning of the American session shows that there are 67% of operators that are selling this pair, compared to yesterday, we noticed a decrease, this could be a sign, that in the next few days we could see a fall of EUR/USD to support levels of 6/8 of murray in 1.2085.

Trading tip for EUR/USD for December 17 – 18

Sell below 1.2225, with take profit at 1.2165, stop below 1.2265 (+1/8 murray)

Buy if the pair rebound at 1.2165 (SMA 21), with take profit at 1.2207 (8/8 murray), and 1.2268, stop loss below 1.2120.

Sell if the pair breaks below 1.2135, with take profit at 1.2085 (6/8 murray), stop loss above 1.2165.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română