Prior 0.10%

- Bank rate votes 0-0-9 vs 0-0-9 expected

- Gilts purchases £875 billion

- Corporate bond purchases £20 billion

- Total asset program £895 billion (unchanged)

- Existing stance of monetary policy remains appropriate

- Vaccine likely to reduce downside risks to economic outlook

- Recent global activity has been affected by increase in virus cases

- Q4 GDP likely to be a little weaker than expected in November report

- Outlook for the economy remains unusually uncertain

- Should market functioning worsen materially again, stands ready to increase pace of asset purchases to ensure effective transmission of monetary policy

- If needed, there is scope to reevaluate existing technical parameters of QE

- Extends term-funding scheme by six months

Besides acknowledging the potential for the vaccine to limit downside risks to the economy, there isn't much change to policy language in general. The BOE still highlights that the outlook is still "unusually uncertain", while maintaining its pledge for more QE.

Further Development

Analyzing the current trading chart of EUR/USD, I found that the buyers are still in control and that EUR is heading towards our main profit targets at 1,2350 and 1,2400.

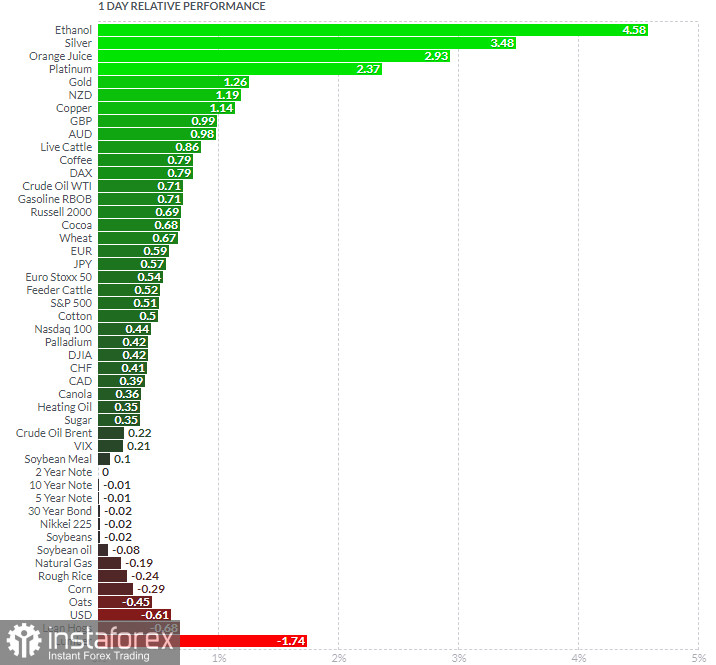

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Silver today and on the bottom Lean Hogs and Lumber.

Key Levels:

Resistance:1,2350 and 1,2400.

Support levels: 1,2178

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română