Latest data from the Mortgage Bankers Association for the week ending 11 December 2020

Prior -1.2%

- Market index 857.3 vs 848.3 prior

- Purchase index 331.6 vs 325.7 prior

- Refinancing index 4,014.5 vs 3,959.2 prior

- 30-year mortgage rate 2.85% vs 2.90% prior

The jump in mortgage activity in the past week comes from a rebound in purchases after the drop in the previous week, with refinancing activity also seen picking up amid the fall in the long-term mortgage rate to the lowest in the survey's history.

Further Development

Analyzing the current trading chart of Gold, I found that the buyers are in control and that we got pullback into the rising trendline today.

Based on the hourly time-frame I found the bullflag in creation, which is another sign for the upside continuation.

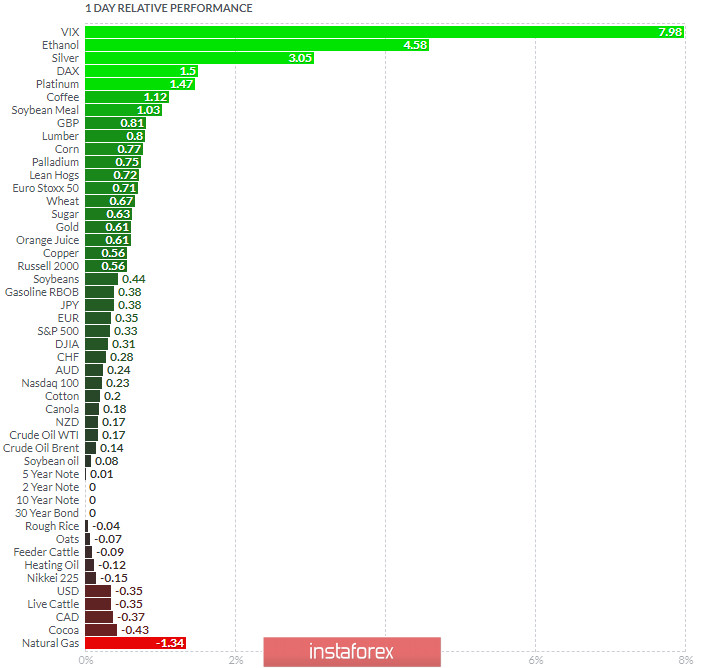

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Ethanol today and on the bottom CAD and Natural Gas.

Key Levels:

Resistance: $1,873

Support level: $1,853

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română