Prior -0.4%; revised to +0.1%

- Industrial production WDA -3.8% vs -4.4% y/y expected

- Prior -6.8%; revised to -6.3%

Industrial production picking up a touch and higher revisions will be welcome news for Q4. The EURUSD is supported this am on the Dollar weakness. One area to watch is that if the EUR becomes too strong we may see some ECB jawboning. A strong euro is not good for European exporters.

Further Development

Analyzing the current trading chart of EUR/USD, I found that the buyers are still in control and that we got breakout of the bullish flag pattern in the background based on the daily time-frame.

My advice is to watch for buying opportunities on the dips using the intraday time-frame, with the upside target at the price of 1,2400.

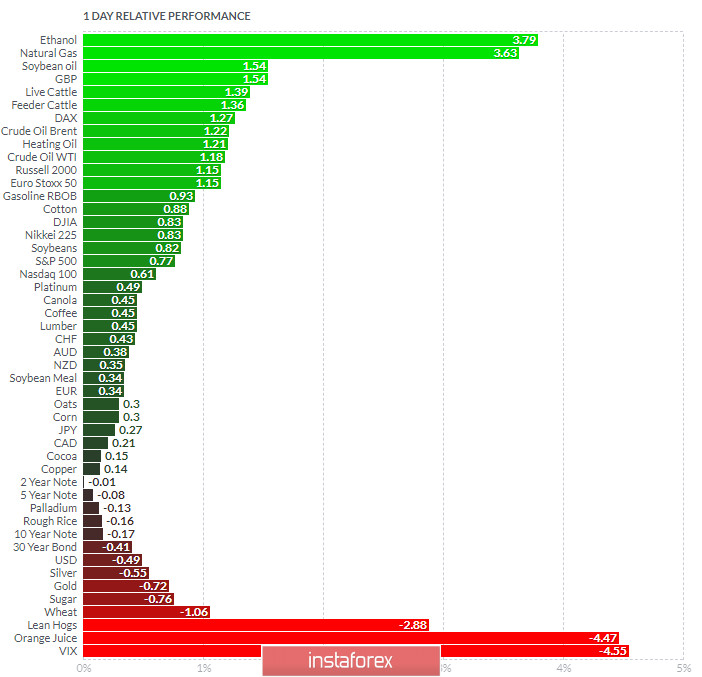

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Ethanol and Natural Gas today and on the bottom VIX and Orange Juice.

EUR is trading in the positive territory, which is positive sign for continuation...

Key Levels:

Resistance: 1,2175 and 1,2400

Support level: 1,2065

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română