Overview :

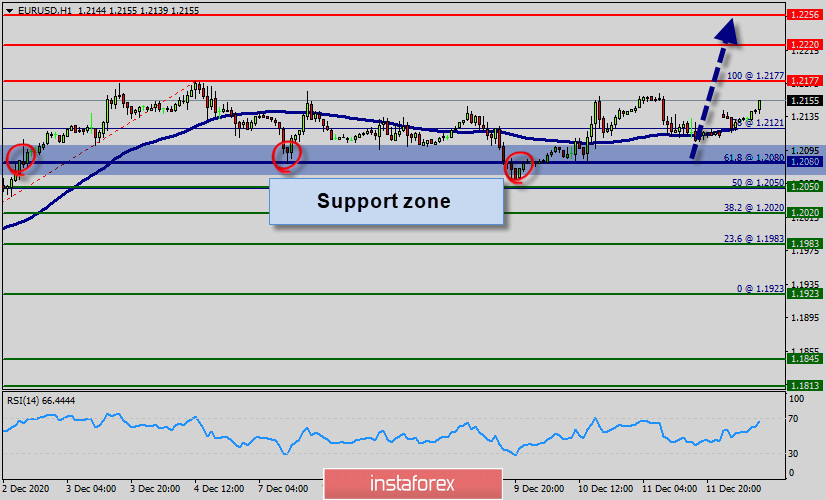

The EUR/USD pair broke resistance which turned to strong support at the level of 1.2080 last week.

The level of 1.2080 coincides with a golden ratio (61.8% of Fibonacci, pivot point), which is expected to act as major support today.

The market opened above the weekly pivot point. It continued to move upwards from the level of 1.2080 to the top around 1.2154. Today, the first resistance level is seen at 1.2177 followed by 1.2220, while daily support 1 is seen at 1.2080.

Right now, the pair is trading above this level (1.2080). It is likely to trade in a higher range as long as it remains above the support (1.2080) which is expected to act as major support today.

Accordingly, the market is likely to show signs of a bullish trend. The trend is still calling for a strong bullish market from the spot of 1.2080. Note that buyers are bidding for a low price.

The Relative Strength Index (RSI) is considered overbought because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours.

This would suggest a bullish market because the moving average (100) is still in a positive area and does not show any signs of a trend reversal at the moment.

Amid the previous events, the EUR/USD pair is still moving between the levels of 1.2080 and 1.2220, so we expect a range of 140 pips in coming hours.

Therefore, the major support can be found at 1.2080 providing a clear signal to buy with a target seen at 1.2177. If the trend breaks the minor resistance at 1.2177, the pair will move upwards continuing the bullish trend development to the level of 1.2220 in order to test the daily resistance 2.

Overall, we still prefer the bullish scenario which suggests that the pair will stay above the area of 1.2080 this week.

However, stop loss should always be taken into account, accordingly, it will be beneficial to set the stop loss below the last bearish wave at 1.2050.

Forecast :

Buy orders are recommended above 1.2080 with the first target at the level of 1.2177. From this point, the pair is likely to begin an ascending movement to the point of 1.2220 and further to the level of 1.2256. The level of 1.2177 will act as strong resistance and the double top is already set at the point of 1.2177. On the other hand, if a breakout happens at the resistance level of 1.2050, then this scenario may be invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română