Forecast :

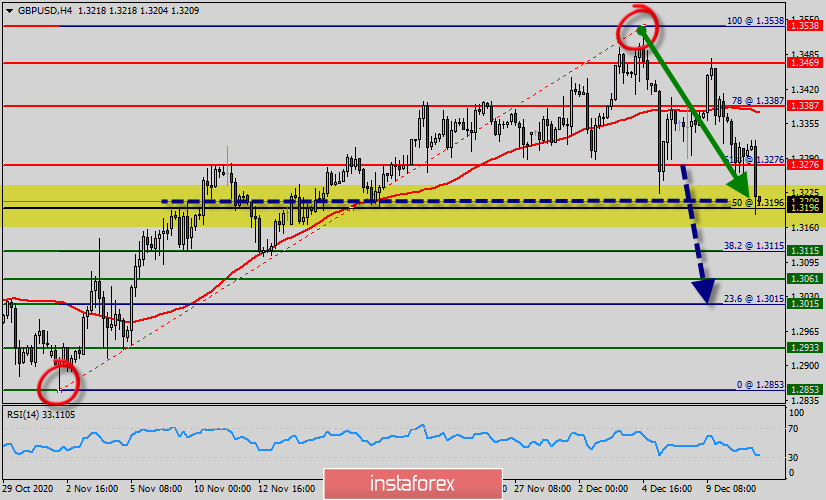

- Our preference below the price of 1.3276 look for further downside with 1.3115 and 1.3061 as targets. The RSI is bearish and calls for further decline.

- Alternative scenario : long positions below the level of 1.3276 with targets at 1.3387 and 1.3469 in extension.

Overview :

The GBP/USD continues its attempts to settle below the nearest support level at 1.3196. The price is still trading around the zone of 1.3276 - 1.3196.

The GBP/USD pair has broken support at the level of 1.3276 which acts as a resistance now.

According to the previous events, the EUR/USD pair is still moving between the levels of 1.3276 and 1.3196.

Therefore, we expect a range of 80 pips in coming minutes at least. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

Hence, the price area of 1.3276 remains a significant resistance zone.

Consequently, there is a possibility that the GBP/USD pair will move downside. The structure of a fall does not look corrective. In order to indicate a bearish opportunity below 1.3276, sell below 1.3276 with the first target at 1.3115.

Besides, the weekly support 1 is seen at the level of 1.3115. From this point, we expect the GBP/USD pair to continue moving in the bearish trend from the support level of 1.3115 towards the target level of 1.3061.

If the pair succeeds in passing through the level of 1.3061, the market will indicate the bearish opportunity belw the level of 1.3061 so as to reach the third target at 1.3015.

The price will fall into a bearish trend with a view to go further towards the strong support at 1.2933 to test it again. The level of 1.2933 will form a double bottom.

However, the daily strong resistance is seen at 1.3276. If the GBP/USD pair is able to break out the level of 1.3303, the market will decline further to 1.3469 (daily resistance 2).

Since the trend is below the 61.8% Fibonacci level (1.3276), the market is still in a downtrend. Overall, we still prefer the bearish scenario.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română