Overview :

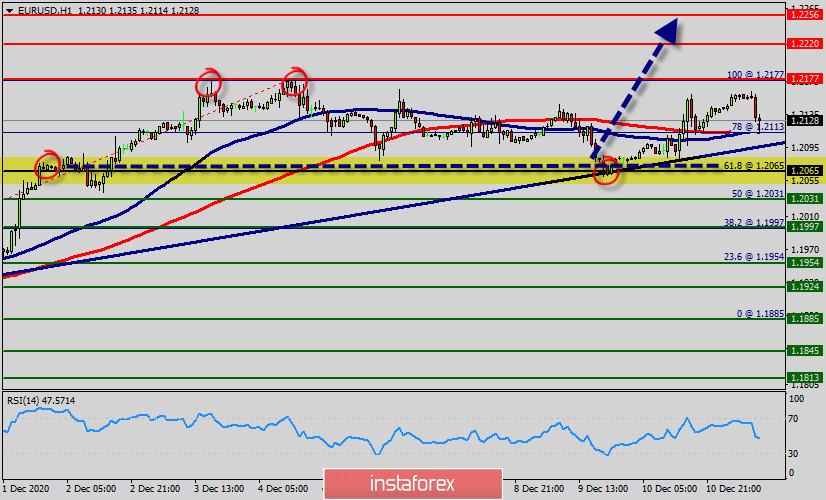

The EUR/USD pair continues to move in our previous forecast. Right now, the price is in a global uptrend - a channel. It hit its after a push to rise at the level of 1.2065. It rebounds from the support line 1.2065 in order to set at the area of 1.2110.

The EUR/USD pair is still bounded in range above the major support of 1.2065 temporary top. Intraday bias remains bullish for the moment. In case of another scaling, upside should be contained by 1.2110 support to bring another rise.

A break of 1.2110 resume whole rise from 1.2110, and target 100% of Fibonacci retracement of 1.2177 so as to form double top.

An uptrend will start as soon, as the market rises above support level 1.2110, which will be followed by moving up to resistance level 1.2177.

Amid the previous events, the price is still moving between the levels of 1.2065 and 1.2177.

The daily resistance and support are seen at the levels of 1.2177 and 1.2177 respectively. In consequence, it is recommended to be cautious while placing orders in this spot. Thus, we should wait until the sideways channel has completed.

The EUR/USD pair set above strong support at the level of 1.2065, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected for four times confirming uptrend veracity.

Hence, major support is seen at the level of 1.2065 because the trend is still showing strength above it.

This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.2110 and further to the level of 1.2177.

The level of 1.2177 will act as second resistance and the double top is already set at the point of 0.6747.

Accordingly, the pair is still in the uptrend from the area of 1.2065 and 1.2110. The EUR/USD pair is trading in a bullish trend from the last support line of 1.2177 towards the second resistance level at 1.2220.

At the same time, if a breakout happens at the support levels of 1.2065 and 1.2031, then this scenario may be invalidated. But in overall, we still prefer the bullish scenario.

Downtrend scenario :

The downtrend may be expected to continue, while market is trading below resistance level 1.2177, which will be followed by reaching support level 1.2065 and if it keeps on moving down below that level, we may expect the market to reach support level 1.2031 and 1.1997.

Forecast :

Buy-deals are recommended above 1.2065 with the first target seen at 1.2177. The movement is likely to resume to the point 1.2220 and further to the point 1.2256. On the other hand, if the EUR/USD pair fails to break out through the support level of 1.203; the market will decline further to the level of 1.1997 (daily support 2).

Daily key levels

- Resistance 3 : 1.2256

- Major resistance : 1.2220

- Minor resistance : 1.2177

- Pivot point : 1.2065

- Minor support : 1.2031

- Major support : 1.1997

- Support 3 : 1.1954

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română