Technical Overview :

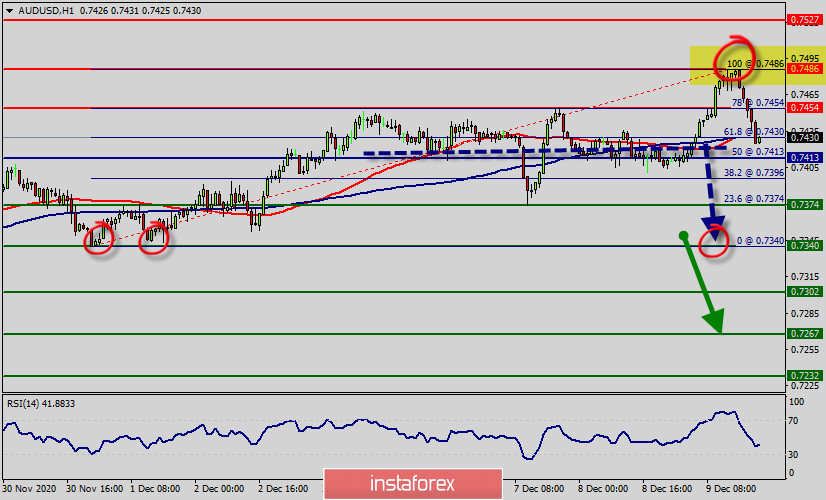

The AUD/USD pair has extended its rally to the top of 0.7486 yesterday. But the pair has rebounded from the top of 0.7486 to close at 0.7432 - ending it a handful of pips below it.

Upside momentum in the AUD/USD pair is bit unconvincing as seen in 1-hour RSI. But further drop is expected as long as 0.7486 major resistance holds.

The Australian dollar has been steadily but painfully advancing against its American rival, and the main reason behind it seems to be the tepid tone of strong news.

On the downside, however, break of 0.7413 will indicate short term topping and turn bias back to the downside for pull back.

Otherwise, current rebound from 0.7486 could still turn out to be a correction in the long term down trend.

The AUD/USD pair is trying to get below the nearest resistance level at 0.7486.

Price has dropped absolutely perfectly from our selling area yesterday and has since made an intermediate recovery. We're back to testing our major resistance again and we look to sell below 0.7486 (100% ofFibonacci retracement, horizontal overlap resistance, bearish divergence, last bullish wave, top point) for a strong drop towards 0.7413 support (Fibonacci retracement) first.

RSI is close to the overbought territory but there is still some room to gain momentum in case the right catalysts emerge. A move below the support at 0.7413 will push the AUD/USD pair towards the next support level at 0.7374.

The AUD/USD pair fell sharply from the level of 0.7486 towards 0.7430. Now, the price is set at 0.7432. The resistance is seen at the level of 0.7486 and 0.7527.

Moreover, the price area of 0.7486/0.7527 remains a significant resistance zone.

Therefore, there is a possibility that the AUD/USD pair will move downside and the structure of a fall does not look corrective.

The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

Thus, amid the previous events, the price is still moving between the levels of 0.7486 and 0.7413. If the NZD/USD pair fails to break through the resistance level of 0.7486, the market will decline further to 0.7413 as as the first target.

This would suggest a bearish market because the RSI indicator is still in a negative spot and does not show any trend-reversal signs.

The pair is expected to drop lower towards at least 0.7374 so as test the daily support 1.

If the trend breaks the minor support at 0.7374 , the pair will move downwards continuing the bearish trend development to the level of 0.7340 in order to test the daily support 2.

Overall, we still prefer the bearish scenario which suggests that the pair will stay below the zone of 0.7413 this week.

So it will be good to resell at 0.7413 with the first targets of 0.7374, 0.7340. It will also call for a downtrend in order to continue towards 0.7267. The strong weekly support is seen at 0.7267.

On the contrary, if a breakout takes place at the resistance level of 0.7527, then this scenario may become invalidated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română