China policymakers reportedly comfortable with yuan appreciation for now

China policymakers reportedly comfortable with yuan appreciation for now PBOC might take action if further rise is rapid, were to hurt country's exports

- Otherwise, would not intervene as there hasn't been any shocks from big capital inflows or outflows due to currency movement

- Some policy advisers see the yuan strengthening to 6.40 per dollar next year

- The yuan is still within a normal range and there is no big deal if it rises further

The above narrative suggests that China still has some room for tolerance to allow the yuan to strengthen further, although they will surely be aware of any major or rapid acceleration should the dollar meltdown go too far, too fast.

A drop in USD/CNY to 6.40 would mean another 2% drop from current levels. Since peaking in late May, the pair has already fallen by roughly 9%.

Further Development

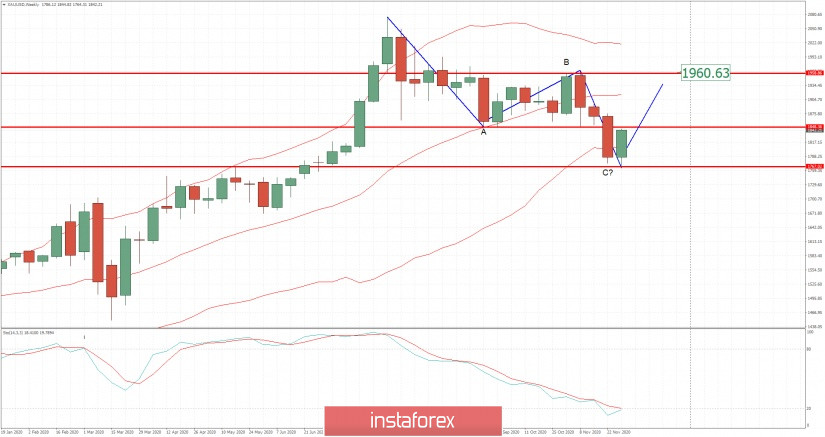

Analyzing the current trading chart of Gold, I found that there is potential for the completion of the downside correction ABC major in the background, which is strong sign for potential upside continuation.

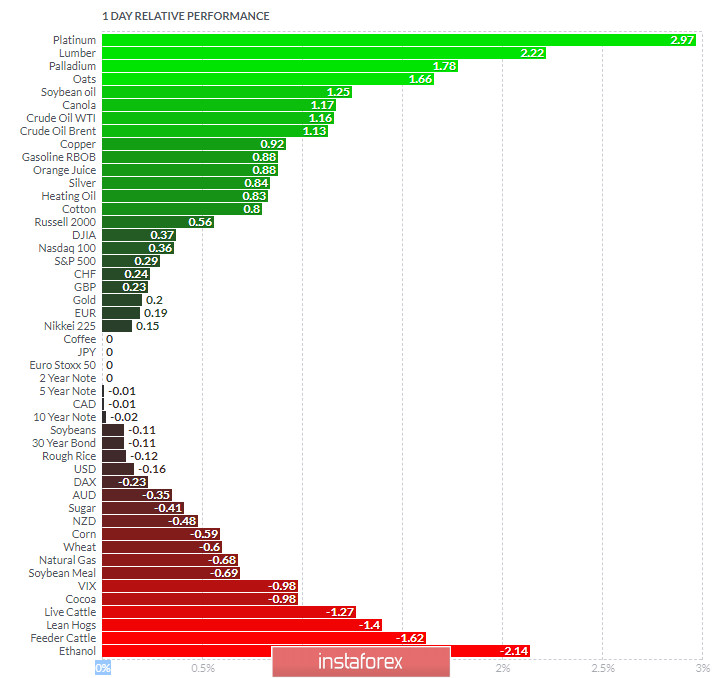

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Platinum and Lumber today and on the bottom Ethanol and Feeder Cattle.

Gold is positive today on the list...

Key Levels:

Resistance: $1,950 and $1,960

Support level:$1,767

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română