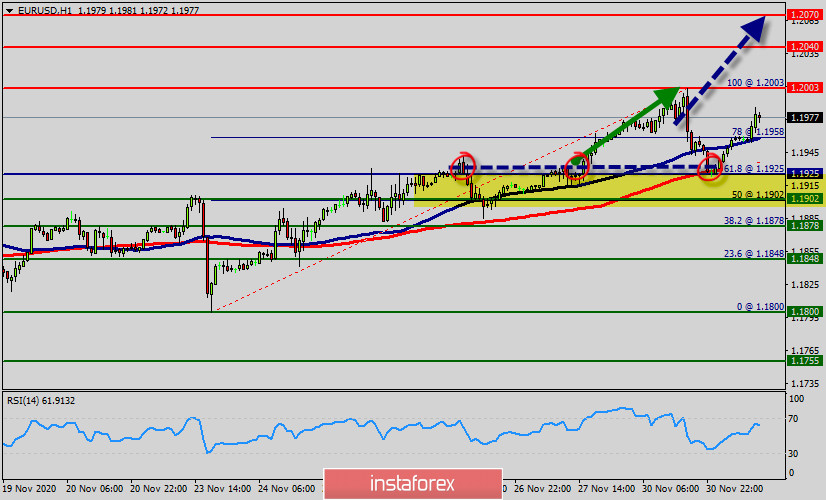

The EUR/USD pair was trading around the area of 1.1925 - 1.1970 a week ago. Today, the level of 1.1925 represents a weekly pivot point in the H1 time frame.

The pair has already formed minor support at 1.1925 and the strong resistance is seen at the level of 1.1925 because it represents the weekly resistance 1.

So, major support is seen at 1.1925, while immediate support is found at 1.1958. This resistance (1.1925) has been rejected two times confirming the validity of an uptrend.

Please notice that this scenario will be invalidated if the price reverses above the wave 2 highs at the level of 1.1925. If the pair closes above the weekly pivot point of 1.1925, the EUR/USD pair may resume it movement to 1.2003 to test the weekly resistance 1.

From this point, we expect the EUR/USD pair to move between the levels of 1.1925 and 1.2040.

Equally important, the RSI is still calling for a strong bullish market, because the Relative Strength Index on the one-hour chart is flirting with the 50 level – nearing overbought conditions.

As well as the current price is also above the moving average 100. Momentum remains to the upside and the EUR/USD pair is trading above the 100 and 50 Simple Moving Averages.

The EUR/USD pair has broken key resistance at the levels of 1.2003, time to buy right now around the spot of 1.2003. Price has finally broken our descending resistance line triggering a strong bullish rise as expected from the are of 1.1925 - 1.2935. We look to sell on strength below major resistance at 1.2003.

As a result, buy above the weekly pivot point of 1.1925 with targets at 1.2003 order to form a double top.

If the EUR/USD pair is able to break out the first resistance at 1.2003, the market will rise further to 1.2040.

In the H1 time frame, the pair will probably go up because the uptrend is still strong. Consequently, the market is likely to show signs of a bullish trend.

Since there is nothing new in this market, it is not bearish yet. rebuy deals are recommended above the level of 1.2003 with the targets indicated above. Major resistance is already set at the point of 1.2070. The pair is likely to move upwards continuing the development of a bullish trend to the level of 1.2070 in order to test the weekly resistance 3.

However, stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss below the last bearish wave at the level of 1.1902. But, we still expect the bullish trend for the upcoming sessions as long as the price is above the 1.1925 price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română