- Vaccine was 100% effective against severe virus cases in trial

- No new serious safety concerns identified since 16 November trial

- To apply for US emergency-use authorisation today

- To apply for EU conditional approval today

- Expects FDA advisory meeting on 17 December

Another Monday, another dose of vaccine optimism to hit the market. Moderna stocks itself are up 10% in pre-market upon the announcement above but the overall jump in risk trades is more measured, all things considered compared to previous vaccine news.

Further Development

Analyzing the current trading chart of EUR/USD, I found that the buyers got exhausted today and the downside roattion would be probably to correct strong upside movement from recent few days.

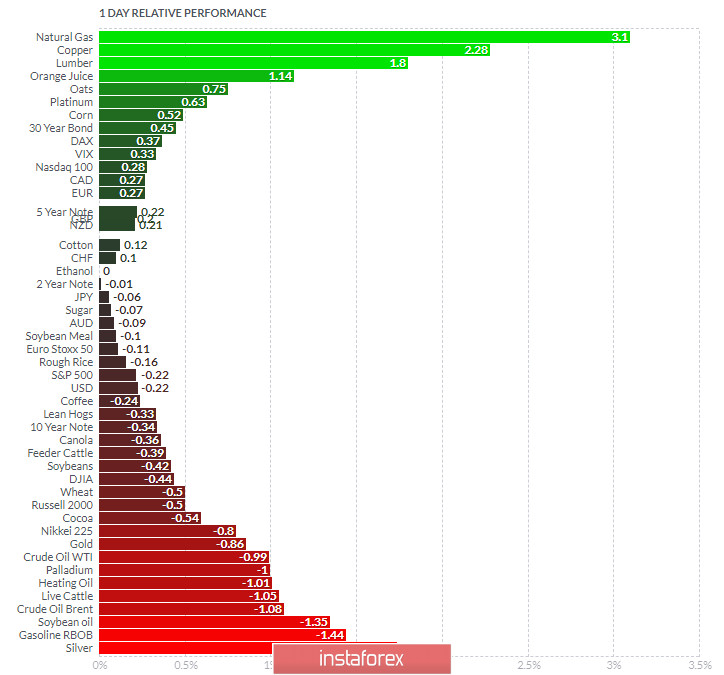

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Cooper and Natural Gas today and on the bottom Silver and Gasoline RBOB.

EUR/USD is slightly positive on the list but with overbought condition...

Key Levels:

Resistance: 1,1990

Support levels: 1,1960 and 1,1940

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română