Prior -0.3%

- Market index 863.6 vs 831.5 prior

- Purchase index 314.6 vs 303.9 prior

- Refinancing index 4,077.7 vs 3,901.6 prior

- 30-year mortgage rate 2.92% vs 2.99% prior

The long-term mortgage rate fell to a survey low in the past week and that is continuing to spur housing market activity, with purchases and refinancing both jumping. After a bit of a slow period in mid-September to October, we're starting to see more of a pickup again.

Further Development

Analyzing the current trading chart fo EUR/USD, I found that there is fake breakout of the breakout of the balance high at 1,1915, which is sign that we might see downside movement.

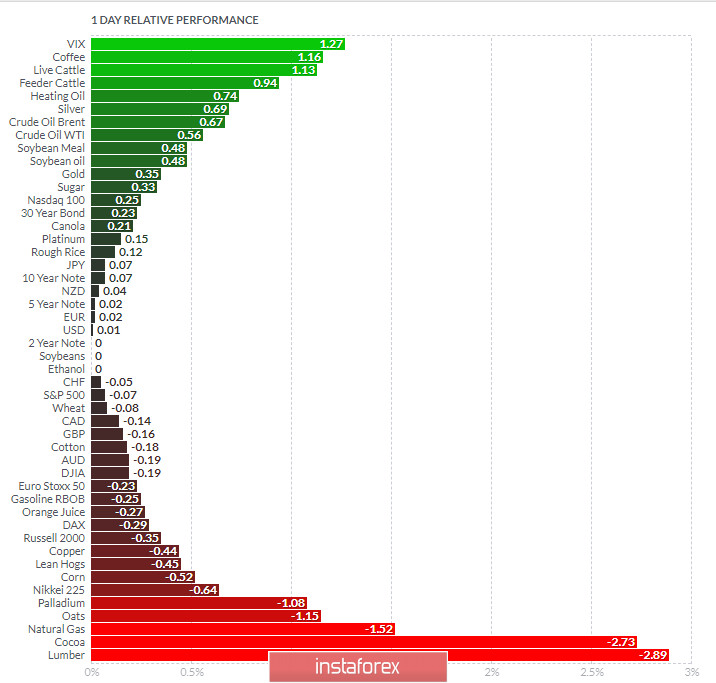

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Coffee today and on the bottom Lumber and Cocoa.

EUR looks neutral on the list but with the fake of multi day high in the background, which is good sign of weakness.

Key Levels:

Resistance: 1,1,915/30

Support levels: 1,1842 and 1,1800.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română