The American dollar is actively sold during the holiday week and then a question arises. This is because someone is trading on a thin holiday market against the dollar, especially collecting the remaining orders of investors. Is it certain that the tax reform factor will support it? Or is this the beginning of a negative trend for the US currency?

Based on an opinion. Obviously, the noticeable drop in the market volumes on the background of a large number of markets. At the same time, the whole market profile purposefully deals with general expectations and sentiments, which allows these players to collect a fairly good harvest before New Year's Eve.

But in this case, it may also be mixed with the desire of some investors to start a new game based on the fact that the emerging market situation, for instance, will be against the dollar. Since it was most likely mixed. If everything is clear with the first scenario, then the second requires explanations.

Similarly, the market came to understand that the world's Central Bank, such as the ECB, the Bank of England, and the Central Bank of Japan, can start changing their monetary policy rates this year. For example, the ECB clearly mentioned about its plan to do so on the wave of rising inflationary pressures. This cannot only be the complete elimination of the quantitative easing program, but also the beginning of interest rate hike. While the British regulator has the same story. As soon as the situation with Brexit is resolved and becomes clearer, then interest rates can increase again while holding its focus towards the growing inflation.

Regarding the situation of the Japanese Central Bank, there is also a possibility of a retreat from a soft monetary policy. In any case, the protocol of the last meeting of the bank was published today and showed an increase in such sentiments within the organization.

With the entire scenario, it becomes clear why the dollar is under pressure. If indeed such changes await us in the new year, then the exchange rate of the American currency can significantly decline in relation to the main currencies.

Forecast of the day:

The EUR/USD pair broke out the range of 1.1840-1.1900 on the wave of the extensive weakening of the dollar. If it overcomes the mark of 1.1925, there is a possibility of its further growth to 1.1960.

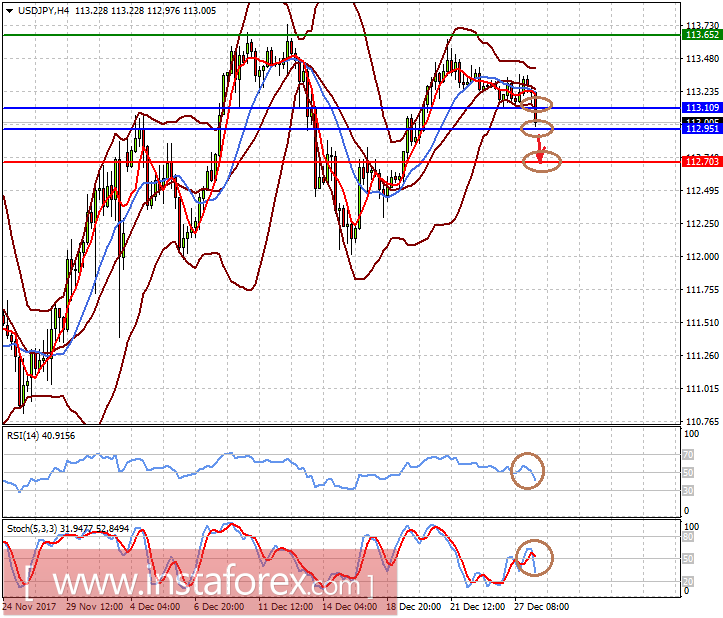

The USD/JPY pair broke through the level of support against the backdrop of the publication of minutes from the last meeting of the Central Bank of Japan, which may be the reason for its local decline to 112.70 after overcoming the level of 112.95.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română