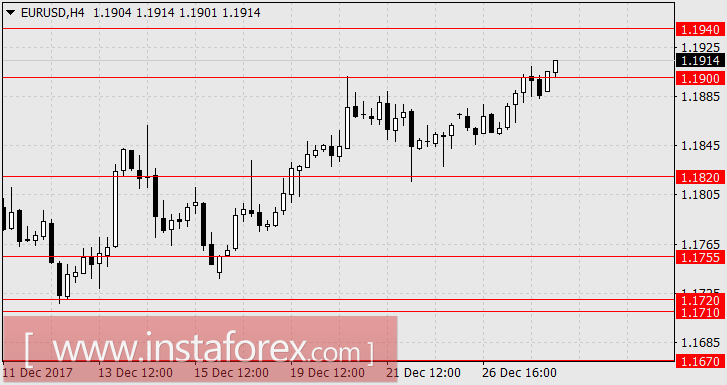

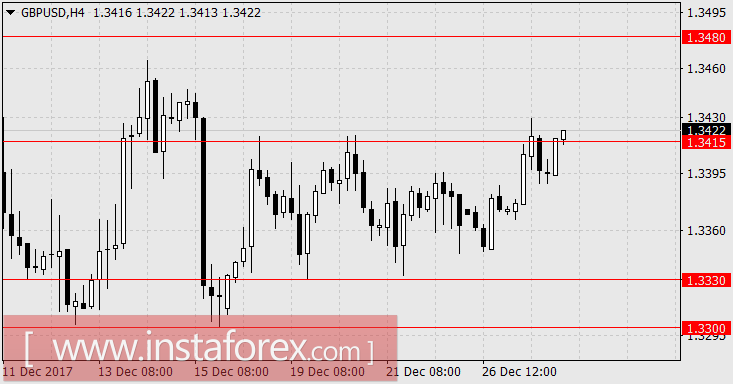

EUR / USD and GBP / USD pairs

On Wednesday, the euro and pound rose by 29 and 23 points respectively, following the strengthening of commodity currencies. However, since there is no particular news from Europe and the U.S., this growth can be taken as a late reaction of the thin market on oil growth on Tuesday, reaching 2.50% because of the explosion of the oil pipeline in Libya. It is also possible to assume the increased sensitivity of the market to a sharp increase in retail sales in Spain by 2.0% in November against the forecast of 0.6%. The U.S. statistics came out mixed with unfinished sales in the secondary real estate market in November and increased by 0.2% against expectations of 0.4%. On the other hand, consumer confidence from the Conference Board for December fell from 128.6 to 122.1 with a forecast of 128.2. The stock market still did not move, which is obviously due to the pre-New Year rally was over.

Today, the U.S. expects moderately optimistic figures, which will be a good reason for fixing the short-term profit or closing positions opened last week. The weekly report on the number of applications for unemployment benefits from the Ministry of Labor is expected to be optimistic and an unusual decrease in the number of applications during the holidays. The forecast value is 240,000 to 241,000 compared to 245,000 a week earlier, whereas unemployment increases during this period. The US trade balance for November is projected to grow from -68.3 billion dollars to 67.6 billion and the wholesale stocks for November could increase by 0.4% against -0.5% in October. The index of business activity in the manufacturing sector of the Chicago region may fall from 63.9 to 62.0 in December.

Now it is likely that the euro will return to 1.1820 and the British pound will fall to 1.3330. In case of the worst performance, the euro will be fixed in the range of 1.9000 / 40 and the pound sterling in the range of 1.3415 - 1.3480. The probability of both scenarios is the same .

USD / JPY pair

The Japanese yen also exhausted its optimism good economic data on Tuesday and simply mimicked yesterday's movements of the US stock market. The broad market index S&P 500 added 0.08%, Dow Jones grew by 0.11% and the yen closed the day by 11 points. Once again, significant indicators came out good this morning in Japan but the yen also cannot use this data. The market is very thin with the fall of the yen by 20 points in 1 minute from the opening of the session, which occurred almost without volume.

The volume of industrial production added 0.6% against the forecast of 0.5% in November and the Industrial Production index was 103.6 points, which is the highest value for the last 22 years. Retail sales increased this month from -0.2% y/y to 2.2% y/y, with expectations for growth to 1.2% y/y. During the Asian session, the yen dropped down even against the growth of the stock market on all platforms of the APR: Nikkei 225 + 0.13%, S & P / ASX200 + 0.10%, China A50 + 0.67%, Kospi SEU + 0.67%.

Thus, the stock markets are sluggish despite the optimistic economic data. There is a probability of its recurrence in the morning break of the price. Tomorrow, there is no scheduled data from Japan. The USD/JPY pair is anticipated to grow towards 113.90.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română