The price of the Australian dollar rises, amid the growth of the commodity market. Commodities such as copper, iron ore, oil demonstrate positive dynamics. Many of them even beat many months records. For example, copper went up to three-year highs, and Brent crude rose to the highs of 2015. The cost of iron ore stabilized around 60-65 dollars per ton, despite the disappointing news from China. This fundamental background led to the growth of the Australian currency.

In particular, the AUD/USD pair was fixed in the 77th figure and gradually moves to the next level, taking advantage of the weakness of the US dollar. The Australian currency has already played all the "internal" fundamental factors that turned out to be quite good by the end of the year.

Despite the decline in inflation, the consumer price index rose to 0.6%, which has been the best result since the end of last year. Unemployment is also at a low level of 5.4% and the number of employees in the report. Confused by the weak growth of the average wage: the figure was at the level of 1.9% for the whole of the whole year and only in December. Moreover, the Reserve Bank of Australia said at the last meeting that salaries will rise next year, judging by the attendant indicators.

The Australian government also remains cautiously optimistic about further prospects. Keeping the inflation forecast at the same level of 2 percent for the next year, the Ministry of Finance announced the expected growth in consumer prices to 2.25%. The same dynamics should continue with 2.5% growth on the CPI in the fiscal year 2019-2020. The Australian authorities also lowered the forecast for the country's budget deficit to 23.6 billion Australian dollars by increasing revenues from corporate tax collection.

The central bank of Australia is less restrained in its optimism, although the rhetoric of its representatives has recently changed. The head of the RBA, Philip Lowe, continues to take a wait-and-see attitude and is not in a hurry to follow the trend of 2017 when the world's leading central banks took the course in tightening the parameters of monetary and credit policy.

In here, it is worth emphasizing that Lowe opposed the further lowering of the interest rate. He said that there is a "necessary balance" at the moment and if violated, economic risks will significantly increase. In particular, the speech is about the possible "overheating" of the real estate market in case of a rate cut. In large Australian metropolitan areas, housing prices continue to rise, despite all the restrictive measures taken last year.

Thus, it can be said that the next step of the regulator is likely to be in the direction of tightening monetary policy, based on the position of the head of the RBA. Another question is when exactly this will happen. In my opinion, traders will need to track first the dynamics of average wage growth in Australia, as well as the basic inflation rate through the consumer price index. If the situation in the commodity market remains at least at the level of current conditions, the resoluteness of the RBA will depend on the above two indicators.

Meanwhile, the growth of the Australian currency is fueled by the commodity market. For example, copper is growing as recorded from the news saying that copper production has stopped in China, as one of the largest enterprises. Again, this is because of the new environmental legislation. And although this is a temporary factor, it plays an important role for the AUD/USD pair against the backdrop of an empty economic calendar.

In general, until the end of this week or the year, the Australian is likely to gradually build up its positions, approaching the 78th figure. However, the key resistance level is slightly higher at 0.7820. Only in case of a breakout and fixing, bulls will be able to count on a large-scale "northern offensive".

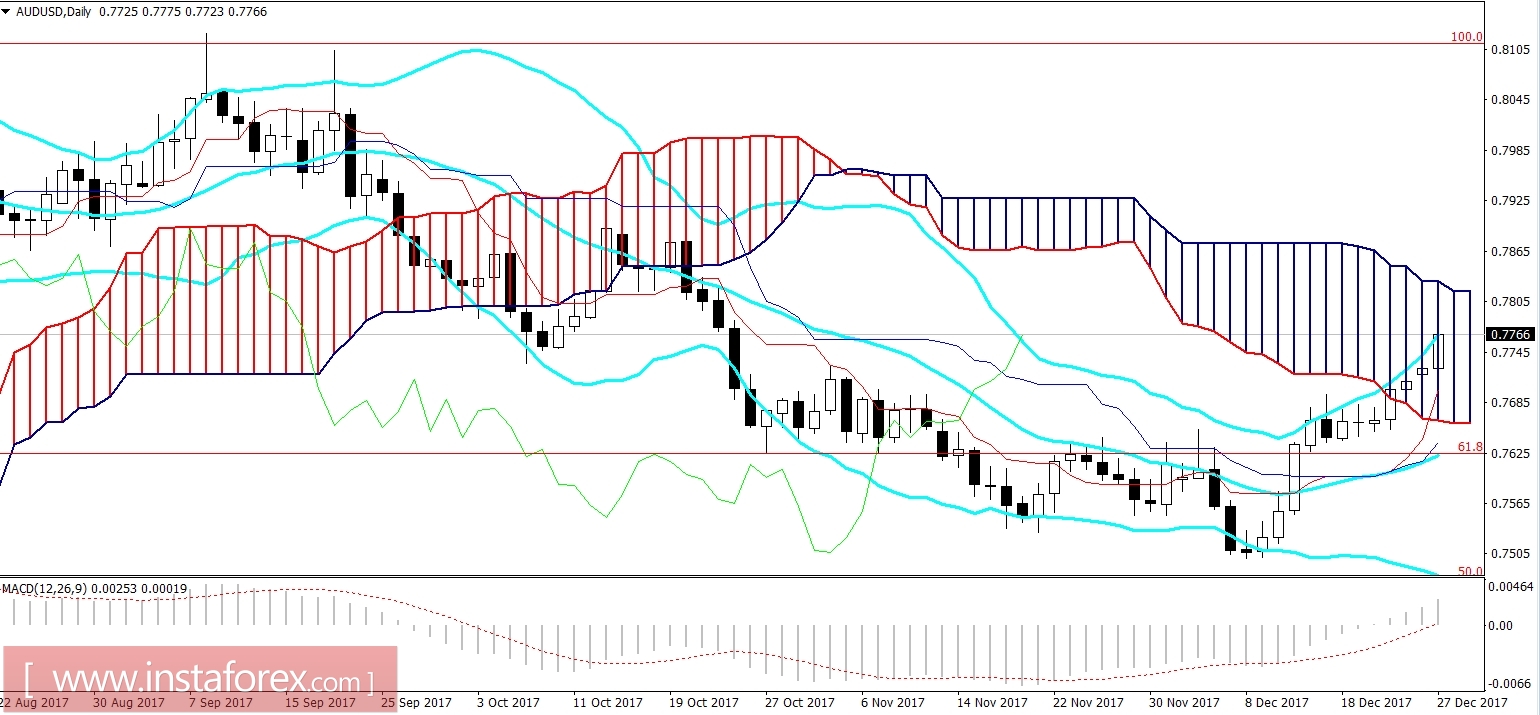

In terms of technical analysis, the situation of the AUD/USD pair is as follows: On the daily chart, the pair is on the top line of the Bollinger Bands indicator and in the Kumo cloud of the Ichimoku Kinko Hyo indicator. Both the Tenkan-sen and Kijun-sen lines of the indicator crossed each other under the price chart and formed a signal "golden cross", which tells us about changing the direction of the pair. Thus, a pronounced bullish trend will begin if the AUD/USD currency pair can penetrate the Kumo cloud of the Ichimoku Kinko Hyo indicator and gain a foothold over it. In other words, the pair will now have to break through and consolidate above the resistance level of 0.7820 to open the way to the 79th figure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română