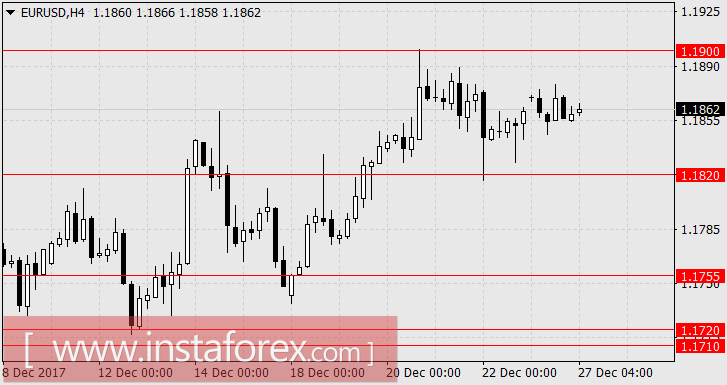

EUR / USD, GBP / USD

On Tuesday, investors have not decided to take an active action in the foreign exchange market. To some extent, this was hampered by the activity on commodity markets as oil gained 2.22%, gold by 0.60%, copper 1.13%, and most of the commodity indices further increased. The stock market was sluggish, as the S & P500 fell by 0.11%. But this situation was lost in the iPhone X, but the shares of Micron Technology dropped even more by -4.41%. Macroeconomic data came out mixed, showing the house price index S & P / Case-Shiller in the 20 largest US cities in October rose from 6.2% YoY to 6.4% YoY, with the expectation of 6.3% YoY. But the business activity index in the manufacturing sector of Richmond for December fellows from 30 to 20, with the expectation of 22.

Today, European markets are connected to trade. Data on the eurozone does not release yet, while investors will focus on political developments in Spain and the receipt of new information on tax reform. According to the United States, there are data on unfinished sales in the real estate market for November, the forecast came in at -0.4% versus 3.5% in October. The consumer confidence index from the Conference Board for the current month is forecasted to decrease from 129.5 to 128.2.

In the Asian session, commodity prices are already falling, oil was reduced by -0.40%, and copper down to -0.64%. While agricultural futures are traded mixed.

The tasks of investors remain the same which is to overcome strong technical resistance on the euro at 1.1820 and reach 1.1755. The British pound needs to overcome 1.3300 / 30 to confidently move on. The question is whether investors will be able to do this in the last four days before the new year.

AUD / USD

Today in the Asian session, investors managed to overcome the psychological pressure of American traders' uncertainty yesterday. Stock indices in general are growing, as the S&P / ASX 200 came in at +0.17%, Nikkei225 0.05%, IDX Composite 0.31%, and China A50 -0.52%. Yesterday, the iron ore went up by 0.11% ($ 70.95). Economic indicators for Australia will not be present until January. However, the data on private sector lending for November will be published on Friday, with the forecast of 0.4%, as in October. At the moment, the price has reached the strong resistance zone of 0.7720 / 50 and to the low of mid-October. The low activity on the market enables traders to have enough enthusiasm to attack it. The Australian business press has absolutely no news. Accordingly, the Australian dollar will follow the US dollar with a decline in the main scenario. In the current situation, we are waiting for the trade in the range of 0.7700 / 40 with a decrease to 0.7640.

* The presented market analysis is informative and does not constitute a guide to the transaction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română