Dear colleagues.

For the EUR / USD pair, the continuation of the upward movement is expected after the breakdown of 1.1898. At the moment, the price is in correction. For the GBP / USD pair, the price entered the equilibrium state at 1.3464. We expect the appearance of a pronounced structure for the top. For the USD / CHF pair, the continued downward movement is expected after the breakdown of 0.9855. The level of 0.9917 is the key support. For the USD / JPY pair, the continuation of the upward movement is expected after the breakdown of 113.50. For the EUR / JPY pair, the price is in the correction zone from the upward structure on December 15. For the GBP / JPY pair, the continuation of the development of the upward structure from December 15 is expected after passing the price of the noise range of 151.89 - 152.10.

Forecast for December 22:

Analytical review of currency pairs in the scale of H1

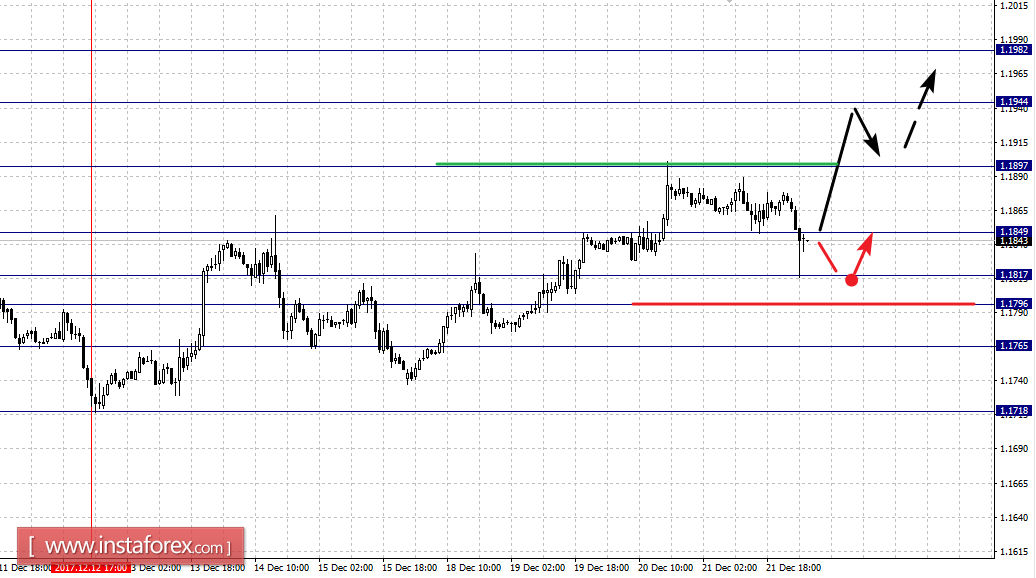

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1982, 1.1944, 1.1897, 1.1849, 1.1817, 1.1796 and 1.1765. Here, the price is in correction from the upward structure on December 12. Continued development of the upward cycle from December 12 is expected after the breakdown of 1.1897. In this case, the target is 1.1944. Near this level is the consolidation of the price. The potential value for the top is the level of 1.1982, upon reaching which we expect a pullback downwards.

We expect the correction to continue after the breakdown at 1.1849. Here, the target is 1.1817. Short-term downward movement is possible in the area of 1.1817 - 1.1796. The breakdown of the latter value will lead to the development of the downward movement. In this case, the first target is 1.1765.

The main trend is the upward structure of December 12.

Trading recommendations:

Buy: 1.1898 Take profit: 1.1942

Buy: 1.1946 Take profit: 1.1980

Sell: 1.1846 Take profit: 1.1820

Sell: 1.1815 Take profit: 1.1798

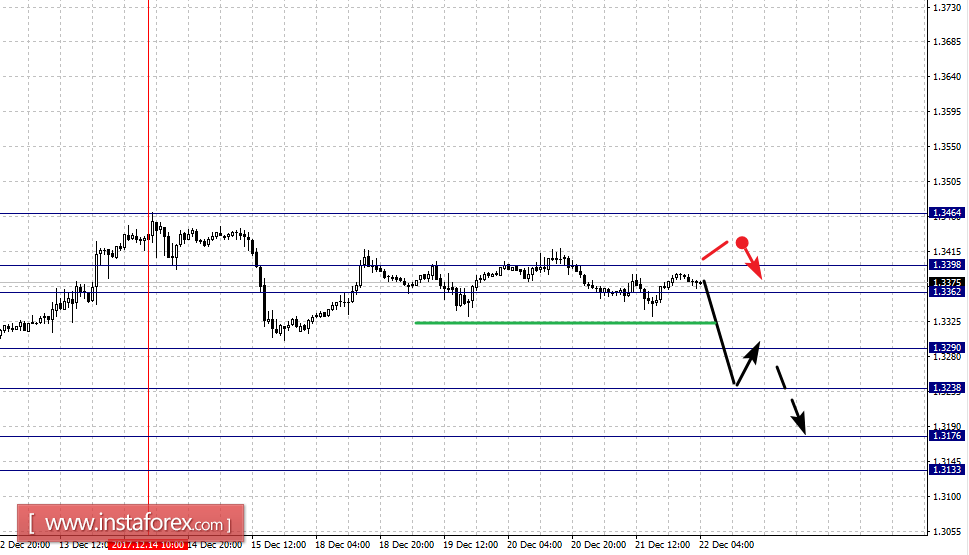

For the GBP / USD pair, the key H1 scale levels are: 1.3464, 1.3398, 1.3362, 1.3290, 1.3238, 1.3176 and 1.3133. Here, we continue to monitor the formation of a downward structure from December 14. At the moment, the price is in correction. The continuation of the downward movement is expected after the breakdown of 1.3290. In this case, the target is 1.3238. Near this level is the consolidation of the price. A breakdown at 1.3235 will lead to the development of a pronounced movement. Here, the target is 1.3176. The potential value for the bottom is the level of 1.3133, upon reaching which we expect a rollback to the top.

Short-term upward movement is possible in the area of 1.3362 - 1.3395. The breakdown at 1.3400 will lead to the development of an upward structure. In this case, the target is 1.3460.

The main trend is the formation of a downward structure from December 14.

Trading recommendations:

Buy: 1.3362 Take profit: 1.3395

Buy: 1.3400 Take profit: 1.3460

Sell: 1.3290 Take profit: 1.3240

Sell: 1.3235 Take profit: 1.3180

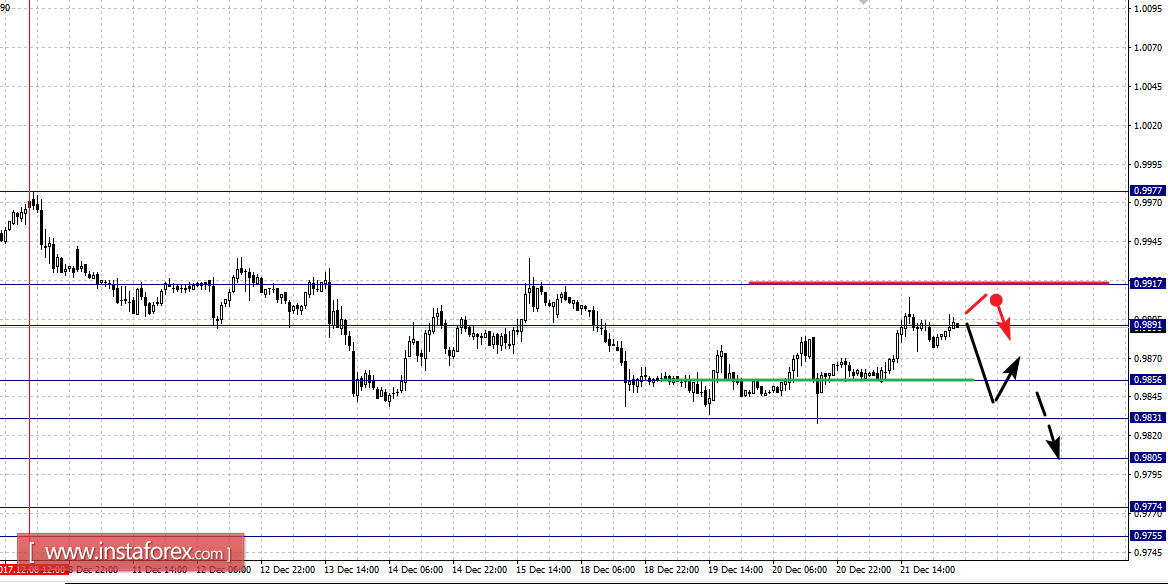

For the USD / CHF pair, the key levels on the scale of H1 are: 0.9917, 0.9891, 0.9865, 0.9831, 0.9805, 0.9774 and 0.9755. Here, we continue to follow the downward structure from December 8. At the moment, the price is in the correction zone. In the area of 0.9856 - 0.9831, we expect consolidated movement. Short-term downward movement is possible in the area of 0.9831 - 0.9805. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.9774. The potential value for the bottom is the level of 0.9755, upon reaching which we expect the departure towards correction.

The range of 0.9891 - 0.9917 is the key support for the bottom. Passing the price will lead to the development of an upward trend. In this case, the potential target is 0.9977.

The main trend is the downward structure of December 8.

Trading recommendations:

Buy: 0.9891 Take profit: 0.9915

Buy: 0.9925 Take profit: 0.9950

Sell: 0.9830 Take profit: 0.9807

Sell: 0.9803 Take profit: 0.9776

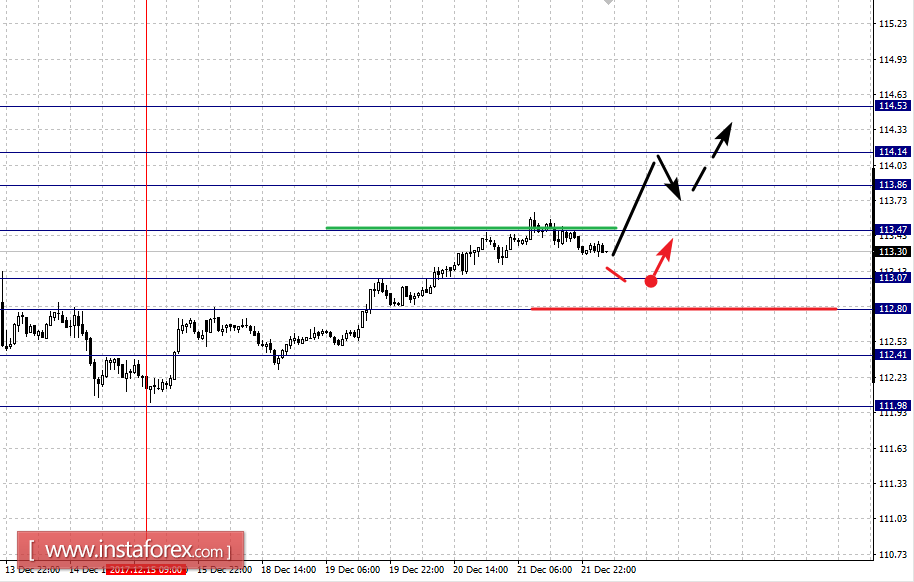

For the USD / JPY, the key levels on a scale are: 114.53, 114.14, 113.86, 113.47, 113.07, 112.80 and 112.41. Here, the continuation of the development of the upward structure from December 15 is expected after the breakdown of 113.47. In this case, the target is 113.86. In the area of 113.86 - 114.14 is the consolidation of the price. The potential value for the top is the level of 114.53, upon reaching which we expect a pullback downwards.

Short-term downward movement is possible in the area of 113.07 - 112.80. The breakdown of the last value will lead to in-depth correction. Here, the target is 112.41. This level is the key support for the top.

The main trend is the upward structure of December 15.

Trading recommendations:

Buy: 113.48 Take profit: 113.84

Buy: 114.16 Take profit: 114.50

Sell: 113.05 Take profit: 112.82

Sell: 112.78 Take profit: 112.45

For the CAD / USD pair, the key H1 scale levels are: 1.2837, 1.2787, 1.2754, 1.2688, 1.2650, 1.2564 and 1.2532. Here, we follow the formation of the downward structure of December 19. Short-term downward movement is possible in the area of 1.2688 - 1.2650. The breakdown of the last value should be accompanied by a pronounced movement to the level of 1.2564. The potential value for the bottom is the level of 1.2532, upon the reaching which we expect the consolidation of the price.

Short-term upward movement is possible in the area of 1.2754 - 1.2787. The breakdown of the last value will lead to in-depth correction. Here, the target is 1.2837. This level is the key support for the downward structure.

The main trend is the formation of a downward structure from December 19.

Trading recommendations:

Buy: 1.2754 Take profit: 1.2786

Buy: 1.2789 Take profit: 1.2835

Sell: 1.2686 Take profit: 1.2652

Sell: 1.2648 Take profit: 1.2566

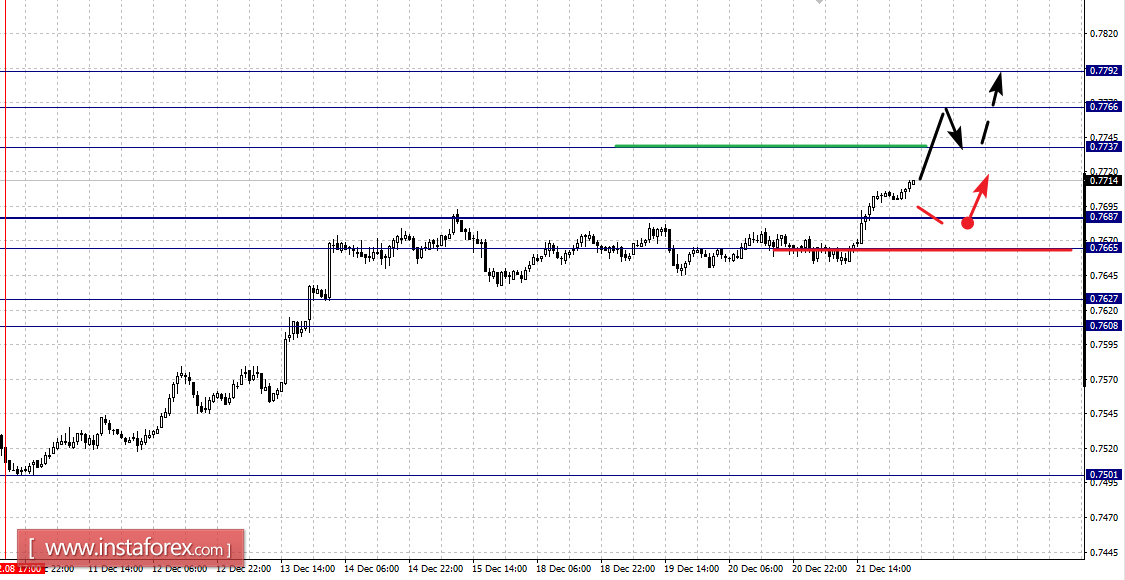

For the AUD / USD pair, the key H1 scale levels are: 0.7792, 0.7766, 0.7737, 0.7687, 0.7665, 0.7627 and 0.7608. Here, we expect to reach the level of 0.7737. Near this level is the consolidation of the price. The breakdown of 0.7739 will allow us to count on the movement towards the level of 0.7766. The potential value for the top is the level of 0.7792, from which we can expect the correction to begin.

Short-term downward movement is possible in the area of 0.7687 - 0.7665. The breakdown of the last value will lead to in-depth correction. Here, the target is 0.7627. The range of 0.7627 - 0.7608 is the key support for the top. Before reaching it, we expect the formulation of pronounced initial conditions.

The main trend is the upward cycle from December 8.

Trading recommendations:

Buy: 0.7739 Take profit: 0.7764

Buy: 0.7768 Take profit: 0.7790

Sell: 0.7685 Take profit: 0.7667

Sell: 0.7660 Take profit: 0.7630

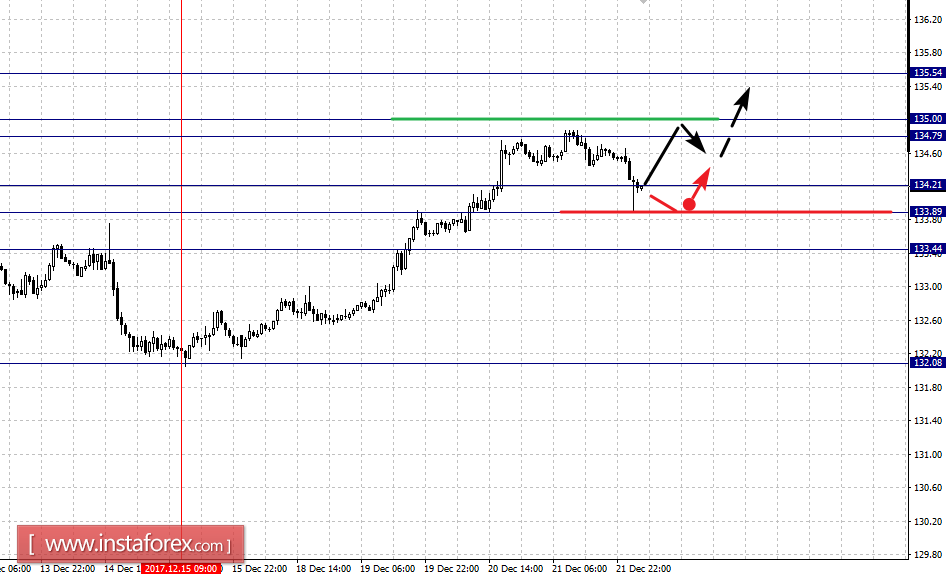

For the of EUR / JPY pair, the key levels on the scale of H1 are: 135.54, 135.00, 134.79, 134.21, 133.89 and 133.44. Here, the continuation of the development of the upward structure from December 15 is expected after passing the price of the noise range of 134.79 - 135.00. In this case, the potential target is 135.54. Upon reaching this level, we expect a pullback downwards.

Short-term downward movement is possible in the area of 134.21 - 133.89. The breakdown of the last value will lead to in-depth correction. Here, the target is 133.45. This level is the key support for the top.

The main trend is the upward cycle of December 15.

Trading recommendations:

Buy: 135.05 Take profit: 135.50

Buy: Take profit:

Sell: 134.20 Take profit: 133.90

Sell: 133.85 Take profit: 133.45

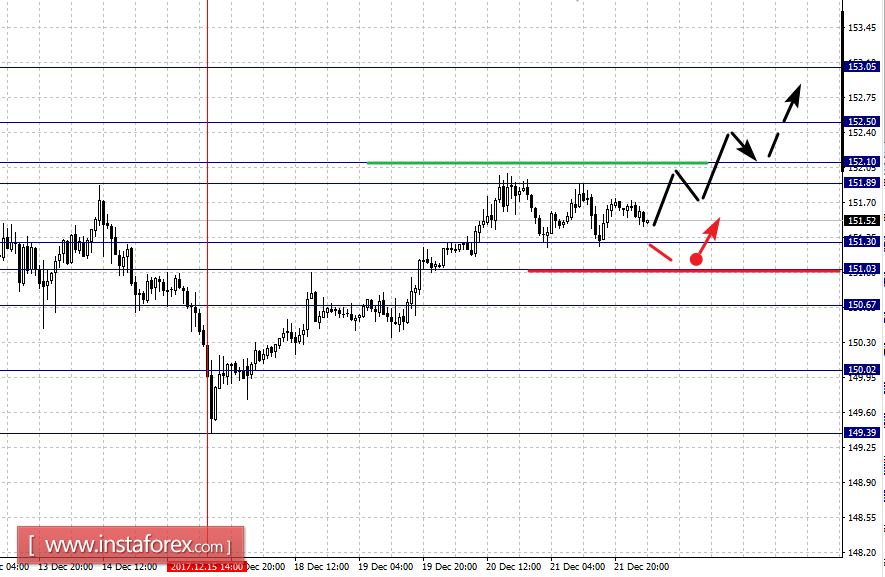

For the GBP / JPY pair, the key levels on the H1 scale are: 153.05, 152.50, 152.10, 151.89, 151.30, 151.03, 150.67 and 150.02. Here, we continue to follow the upward structure of December 15. The continuation of the upward movement is expected after passing the price of the noise range of 151.89 - 152.10. In this case, the target is 152.50. The potential value for the top is the level of 153.05, upon reaching which we expect the departure towards correction.

Short-term downward movement is possible in the area of 151.30 - 151.03. The breakdown of the last value will lead to in-depth movement. Here, the target is 150.67. This level is the key support for the top.

The main trend is the upward structure from December 15, the correction stage.

Trading recommendations:

Buy: 152.10 Take profit: 152.50

Buy: 152.53 Take profit: 153.00

Sell: 151.30 Take profit: 151.05

Sell: 151.00 Take profit: 150.70

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română