This seems to be the safety net in case negotiations next week continue to lead nowhere. The pressing issue now is time as EU officials view that a deal needs to be struck by next Monday in order to facilitate the translation and ratification before the year-end.

According to RTE Europe editor, Tony Connelly:

Another standout element of today's briefing is that officials are considering Provision Application of the agreement because time is diminishing so fast, ie that an agreement wd provisionally come into effect on Jan 1 but that all the ratification procedures wd happen after. Those would include ratification by the European Parliament some time early in the new year - not clear yet how that will go down with MEPs.

Such a move will bring up the debate on whether or not the deal would be "mixed" or "EU only" but that would be a technicality that they should be able to easily work out in the end; not withstanding the three key outstanding issues of course.

Further Development

Analyzing the current trading chart of Gold, I found that the buyers got exhausted today and that there is the breakout of the rising trend line in the background, which is sign for potential downside continuation.

My advice is to watch for selling opportunities with the target at the price of $1,852.

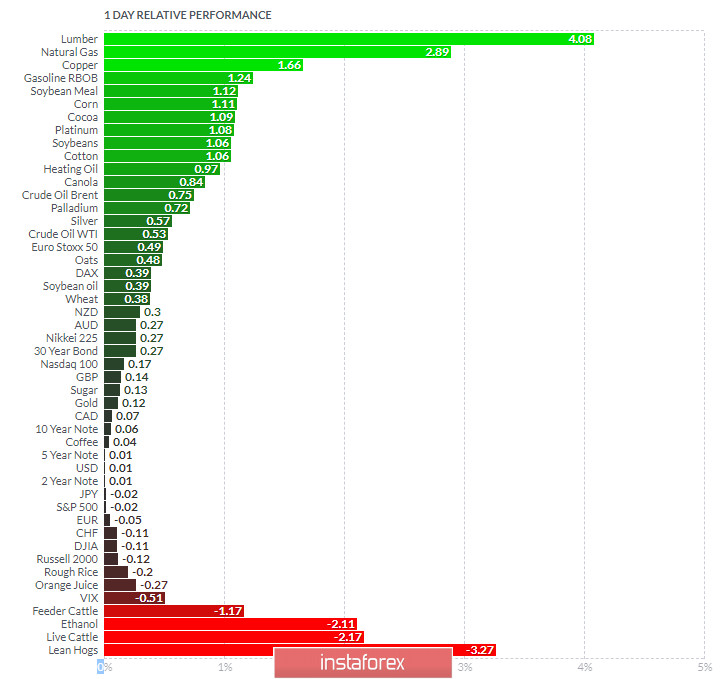

Finviz Relative Strength -

Based on the graph above I found that on the top of the list we got Lumber and Natural Gas today and on the bottom Lean Hogs and Live Cattle.

Gold is neutral on the list, which is sign of the sideways regime...

Key e:

Resistance: $1,870

Support level: $1,850

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română