The American financial world froze in anticipation: U.S. congressmen actually agreed on a single draft of the tax reform, and this week a historic vote can take place. On Friday, the last compromise amendments were adopted that satisfied the interests of all Republican congressmen. Now both chambers of the Congress must vote for this document, after which the reform will be sent for signature to Donald Trump.

The House of Representatives, most likely, will vote for the bill tomorrow, December 19. The Senate has not yet decided on the date, however, by common expectation, the vote will also take place this week. Thus, the White House will receive an approved law before the Catholic Christmas, as planned by Donald Trump. It should also be noted that the US president promised not to delay consideration - on Saturday he said that if approved by Congress, the country will get a new law before the New Year. In other words, tax reform can get real features within the next 10 days, and this fact (in theory) should provide strong support for the dollar. But in reality we see a mirror situation. The American currency began trading week sluggishly, and in many pairs and at all actively becomes cheaper. What is the reason?

First, the market is oversaturated with information on tax reform. Each stage, each step back and forth, was vigorously discussed by analysts. For several months the probability of adopting the reform grew, and this factor was taken into account by investors. After a successful vote in the House of Representatives and (especially) in the Senate, it became clear that agreeing on the final version is only a matter of time. Moreover, the Republican congressmen have shown a contractual capacity and in a relatively short period of time they were able to find the common denominator of the two versions.

The agreed version did not surprise the market. The main provisions remain the same: the profit tax will drop to 21% (previously it was about 20%), and for corporations, it will introduce a separate regime of tax payments from foreign profits.

Separately, it could also be said about the repatriation of profits. The new tax law will enable US businesses to once and for all recover the funds that they earned abroad at a reduced rate. The rate was one of the stumbling blocks of the proceedings - the Senate had its own version, which was different from the version of the House of Representatives. To date, the agreed version is as follows: 8% for liquid assets and 15.5% for cash. This is somewhat more than previously thought.

Nevertheless, even with such rates, Donald Trump is very optimistic. According to him, these innovations will allow the return of about four trillion dollars to the country. It is difficult to say how much his words are justified, while the data on the growth of public debt are more reasoned: economists say the indicator will increase by 1.5-2 trillion dollars until 2027.

In general, the general "fuse" of the market regarding the tax reform has, so far, come to nothing: the fact of progress in the process of agreeing a single legislation was actually ignored by the market. In addition, analysts' opinions began to sound more and more often that the macroeconomic impact of the reform will not be as fast and effective as many traders expect. In particular, Deutsche Bank analysts predicted that the tax overhauls will first of all be felt by households and business. However, the key indicators of the economy will not show an impulse jump - at least in the near future.

This issue is also of a debatable nature, so the real reason for today's decline in the dollar lies in a completely different plane. The fact is that the US has not yet adopted a state budget for the next year, and Donald Trump had to pass a resolution on extending the federal government's funding until next Friday, that is until December 22. The current situation is very similar to the events of 2015, when Obama signed a similar document with a similar "deadline." Then the account was already literally on the clock and resolved at the last minute.

Now there are more significant differences between Republicans and Democrats than two years ago. In addition to the notorious tax reform, there is still an immigration issue, as well as a position on the NAFTA (North American Free Trade Agreement between the United States, Canada and Mexico). Political negotiation is difficult: at first the Democrats boycotted the talks, but last week they agreed to "listen to the position" of their opponents. And this despite the fact that the financial year in the US began on October 1.

Rumors around the negotiating process also did not bode well traders. According to sources of the influential Reuters agency, the parties will not have time to agree on the financial bill not only until December 22, but in general before the end of this year. Discussion will be postponed until January, and the market will live in conditions of uncertainty. After all, without extending the above resolution, all US ministries, departments and other government agencies will stop working because of a lack of funding.

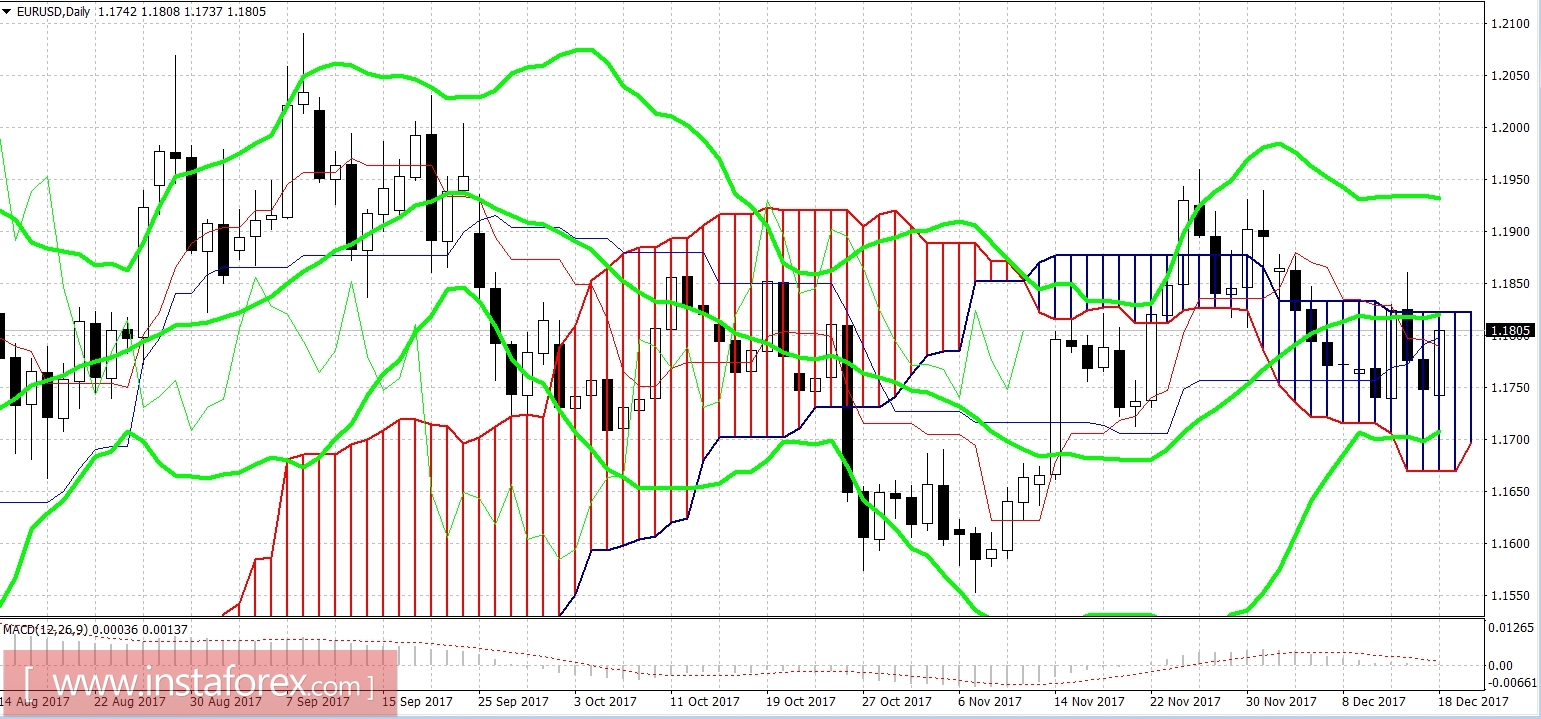

If we talk directly about the EURUSD currency pair, then the price has grown not only because of the temporary weakness of the dollar. Political events in Germany, where the Social Democratic Party again agreed to talk about the formation of a coalition with the Merkel party, supported the European currency. This indirectly affected the dynamics of the pair and the fact that the final assessment of inflation in the euro area coincided with the preliminary value also had an impact.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română