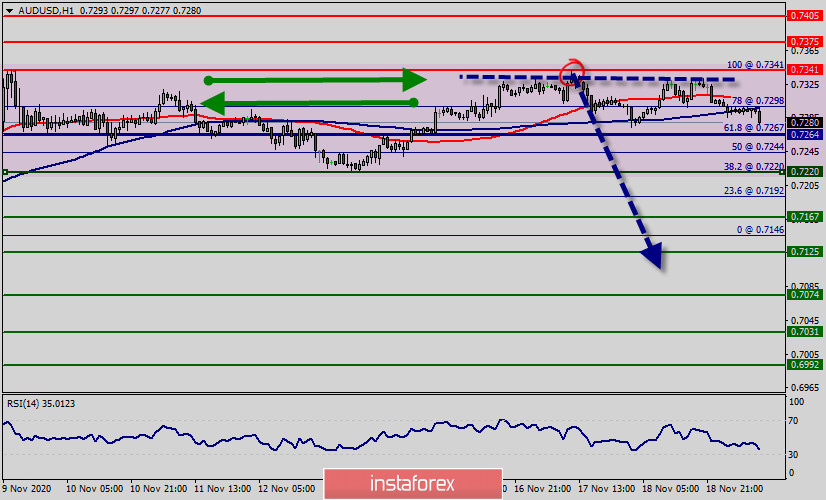

The AUD/USD pair extended its sideways consolidative price action through the early European session and remained confined in a narrow trading band just below the spot of 0.7341. Range 0.7341 - 0.7264.

In long term, the expected trading range for today is between 0.7341 resistance and 0.7167 support. The expected trend for today is bearish as long as the trend is still below the level of 0.7341.

In general, we will continue to suggest the bearish trend for the upcoming period conditioned by the price stability below 0.7341and 0.7300 levels, noting that the EMA100 supports the suggested bearish wave.

The AUD/USD pair has broken support at the level of 0.7300 which acts as a resistance now. According to the previous events, the AUD/USD pair is still moving between the levels of 0.7300 and 0.7220.

Again, the trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Hence, the price area of 0.7341/0.7300 remains a significant resistance zone.

Consequently, there is a possibility that the AUD/USD pair will move downside. The structure of a fall does not look corrective.

In order to indicate a bearish opportunity below 0.7300, sell below 0.7300 with the first target at 0.7220.

Besides, the weekly support 1 is seen at the level of 0.7220. Equally important, the RSI is still calling for a strong bearish market. As a result, resell below the weekly pivot point of 0.7220 with targets at 0.7167 and 0.7125 in order to form a double bottom.

Nevertheless, stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 0.7375. Overall, we still prefer the bearish scenario.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română