BOE actions are not monetary financing

- We have had encouraging news on the vaccine front

- Vaccine news will play a major role in lowering level of uncertainty

- We can now see some light at the end of the tunnel

- But need to focus more on how the economy will look in the future

- There are no grounds for complacency, expect BOE to be cautious

He sounds a tad more optimistic amid the recent vaccine news, as that may help to steer some of the pressure away from the debate on negative rates for now.

But as the UK economy continues to underwhelm and Brexit uncertainty reigns, it may be tough to distract from further easing measures for too long.

Further Development

Analyzing the current trading chart of EUR/USD, I found that the EUR/USD tested the median Pitchfork line with the bear divergence on the Stochastic oscillator, which is sign for the potential downside rotation.

My advice is to watch for selling opportunities on the rallies with the downside targets at 1,1840 and 1,1815.

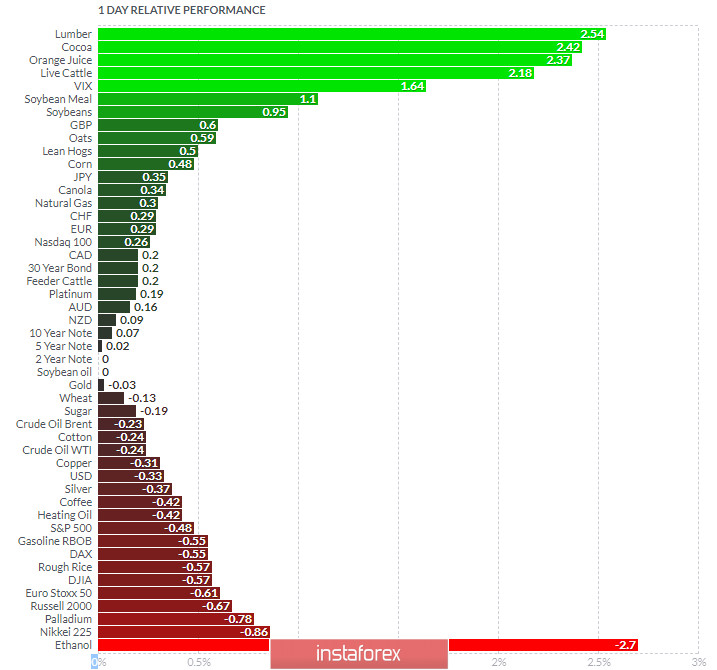

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Cocoa today and on the bottom Ethanol and Nikkei 225

EUR is positive today but the momentum is decreasing...

Key Levels:

Resistance: 1,1890

Support levels: 1,1840 and 1,1815.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română