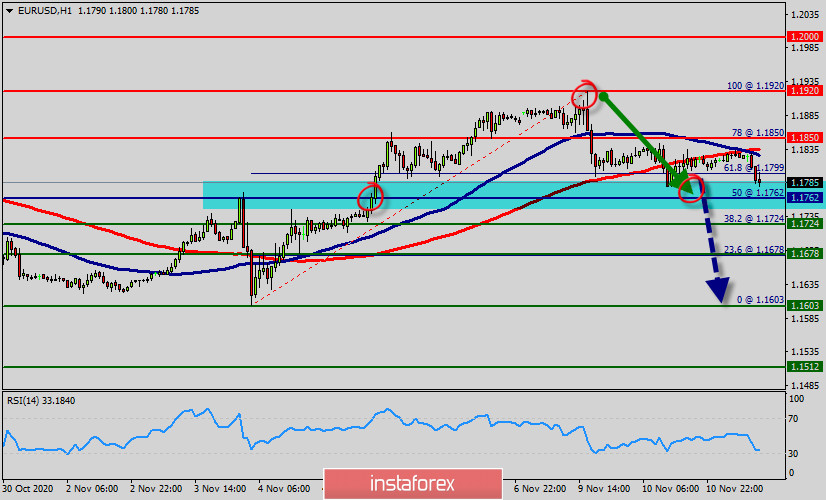

The trend of EUR/USD pair movement was controversial as it took place in the downtrend channel. Due to the previous events, the price is still set between the levels of 1.1850 and 1.1603.

So it is recommended to be careful while making deals in these levels because the prices of 1.1850 and 1.1603 are representing the resistance and support respectively.

The trend is still calling for a strong bearish market from the spot of 1.1850 - 1.1800.

Today, in the one-hour chart, the current fall will remain within a framework of correction. However, if the pair fails to pass through the level of 1.1850, the market will indicate a bearish opportunity below the strong resistance level of 1.1850 (the level of 1.1850 coincides with the double top too).

Since there is nothing new in this market, it is not bullish yet. Therefore, it is necessary to wait till the downtrend channel is passed through. Then the market will probably show the signs of a bearish market.

The Relative Strength Index (RSI) is considered oversold because it is above 40. The RSI is still signaling that the trend is downward as it is still strong below the moving average (100). This suggests the pair will probably go down in coming hours.

In other words, sell deals are recommended below the price of 1.1850 with the first target at the level of 1.1762. From this point, the pair is likely to begin an descending movement to the price of 1.1762 with a view to test the daily support at 1.1678.

If the trend breaks the support level of 1.1678, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.1603 in order to test the double bottom.

Forecast

If the pair fails to pass through the level of 1.1850, the market will indicate a bearish opportunity below the strong resistance level of 1.1850.

In this regard, sell deals are recommended lower than the 1.1850 level with the first target at 1.1762. It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.1678. The pair is expected to drop lower towards at least 1.1603.

However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.1920 (notice that the major resistance today has set at 1.1920).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română