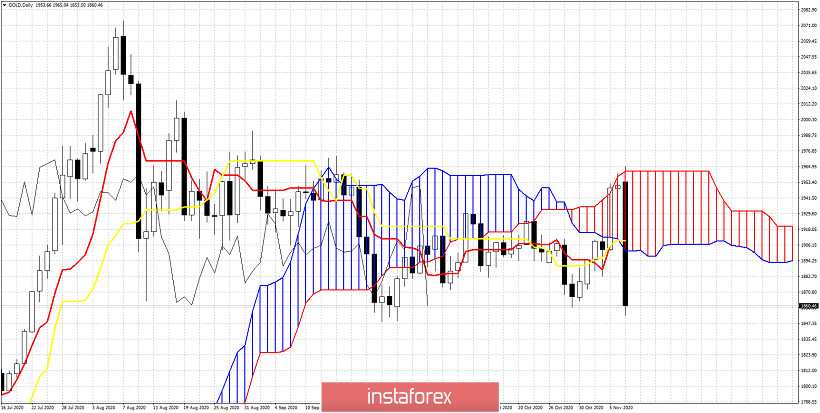

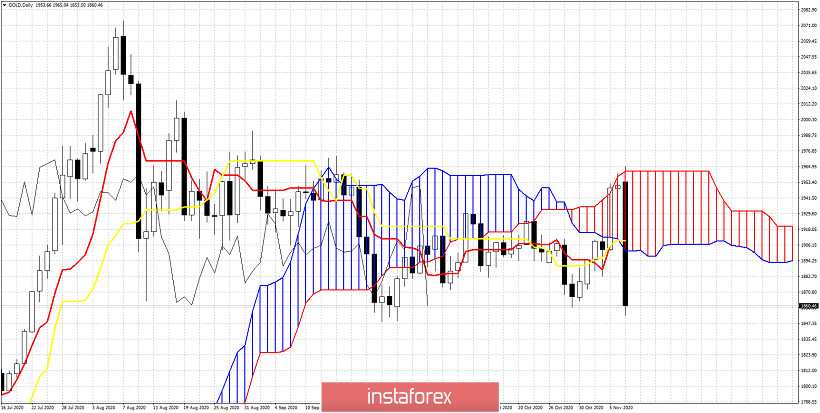

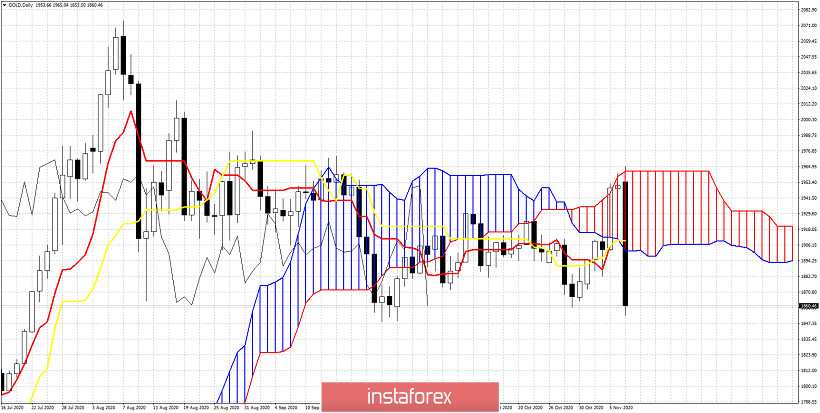

Gold bulls seemed last week that they were under control of the trend. Breaking above $1,920-30 and recapturing the $1,950 level were signs that bullish strength was on its way.....However the bulls never managed to break above the cloud resistance.

Gold bulls tried to break above the Kumo (cloud) last week two times but they could not. Today not only we saw a rejection in price but also a break down below the cloud. This is very bad news for short-term trend in Gold. Gold price is challenging $1,855. Gold bulls managed to break above the short-term resistance levels but could not break and stay above the $1,950 area. The bearish turn around today signals more weakness to come as price has broken very easily below $1,900 again. The $1,900 and $1,950 levels were noted several times before in our analysis. Momentum now favors bears and a break below $1,850 towards $1,800.

Gold price is already trading below last weeks low. This is very bad news for bulls. This implies a move towards $1,750 is very probable. Bulls need to recapture at least $1,900 in order to avoid such a pull back. Bears now want price to continue making lower lows and lower highs. Stop loss for bears is today's high.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

Relevance until

Relevance until