Experimental vaccine found to be over 90% effective in preventing COVID-19

- No serious safety concerns have been identified as of first interim analysis

- Plans to seek US emergency-use authorisation soon after reaching safety milestone in late November

S&P 500 futures just hit a record high and are up by over 2% now with USD/JPY rising to a session high of 103.92 and closing back in on the 104.00 handle.

Notably, bonds are selling off as well with 10-year Treasury yields jumping from 0.81% to 0.85% currently as risk assets rally on the headlines above.

The news is undoubtedly good in terms of the vaccine development and effectiveness, and that just bolsters sentiment that there are 'good times' to look forward to.

Further Development

Analyzing the current trading chart of the Gold, I found that both my Friday's targets at the $1,935 and $1,917 has been reached.

The momentum is ultra strong to the downside after the Vaccine announcement today, which is sign that there is potential for more downside and potential test of $1,8.60

Watch for selling opportunities on the rallies with the target at the price of $1860

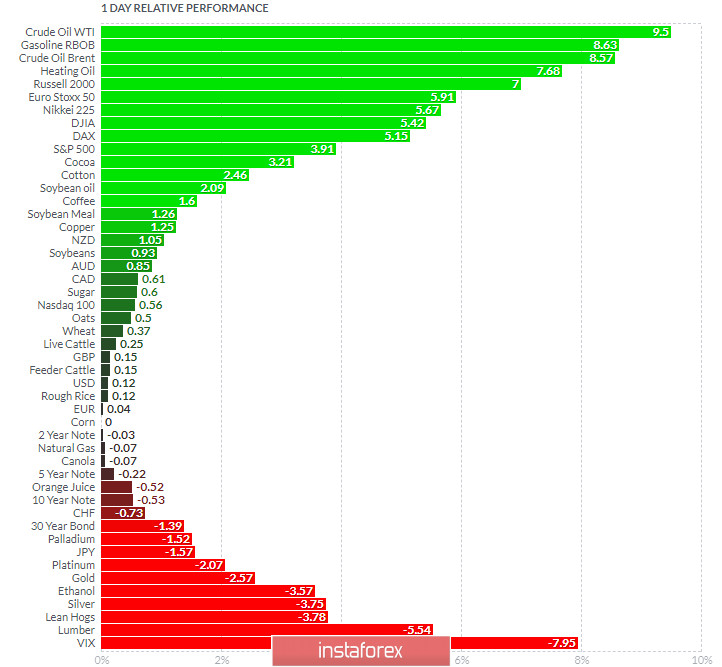

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Crude Oil and Gasoline today and on the bottom VIX and Lumber,

Gold is very negative on the list today, which is another indication of the selling pressure.

Key Levels:

Resistance: $1,907 and $1,921

Support level: $1,860

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română