The euro rose against the US dollar in Wednesday's trading session, November 15, despite another wave of positive macroeconomic statistics on the US economy including the growth in retail sales and inflation. However, it was not possible to break above the key resistance levels.

In the first half of the day, risky assets supported data on the growth of the euro zone's foreign trade surplus which reached another historic high September of this year. The growth was due to increased exports of goods.

According to the report of the statistics agency, the euro zone's trade surplus rose to EUR 25.0 billion in September 2017 from EUR 21.0 billion in August. Exports in September compared with August rose by 1.1%, while imports fell by 1.2%.

Based on this report, we can conclude that it is likely that the economic growth of the euro zone in the third quarter will again demonstrate a very good performance.

As noted above, data on consumer prices in the US did not provide significant support to the US dollar in the afternoon, as there is a slowdown in growth.

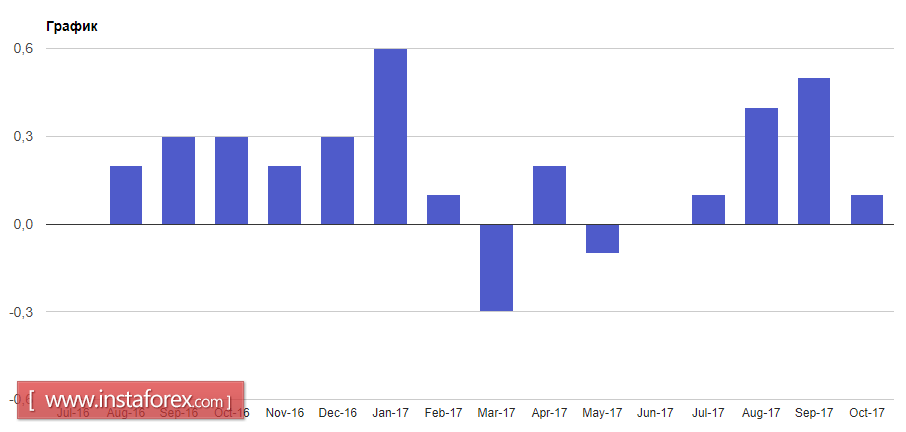

According to the report of the US Department of Labor, the consumer price index rose by 0.1% in October compared to the previous month. Prices for food products remained at the same level while raw materials fell.

The basic CPI index, which does not take into account these volatile categories, grew by 0.2%. Economists predicted an increase in the overall CPI index by 0.1% while the base one would grow by 0.2%. Compared to the same period in 2016, consumer prices rose by 2%.

Expenditures of Americans in October increased moderately, which will not necessarily affect the overall economic indicator positively. According to the US Department of Commerce, retail sales in October 2017 increased by 0.2% compared to the previous month and amounted to 486.55 billion dollars. Compared to October of the previous year, sales increased by 4.6%. Economists predicted a monthly growth of only 0.1%.

The British pound collapsed after data on the number of employees in the UK from July to September this year decreased, indicating a weakness in the labor market.

According to the report of the National Bureau of Statistics of Great Britain, the unemployment rate was at 4.3% and the total number of employees was reduced by 14 000. The annual growth of wages for the reporting period also remained unchanged and amounted to 2.2%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română