According to Bloomberg, China has ordered commodities traders to stop importing products including coal, barley, copper ore and concentrate, sugar, timber, wine and lobster from Australia, citing people familiar with the situation.

The notice is said to have been delivered verbally to major traders in China during meetings in recent weeks. Iron ore - Australia's biggest export to China - are not to be included in the trading halt though, according to the sources.

Further Development

Analyzing the current trading chart of EUR, I found that the prior to the elections in US EUR is trading flat in past 30 days, which is indication of the blanced market regime.

The breakout of resistance at the price of 1,1876 can lead gold for test of 1,2

The breakout of support at 1,1600 can lead gold for test of 1,1500 and 1,1400

EUR is much closer to the downside breakout since it is trading near the balance support....

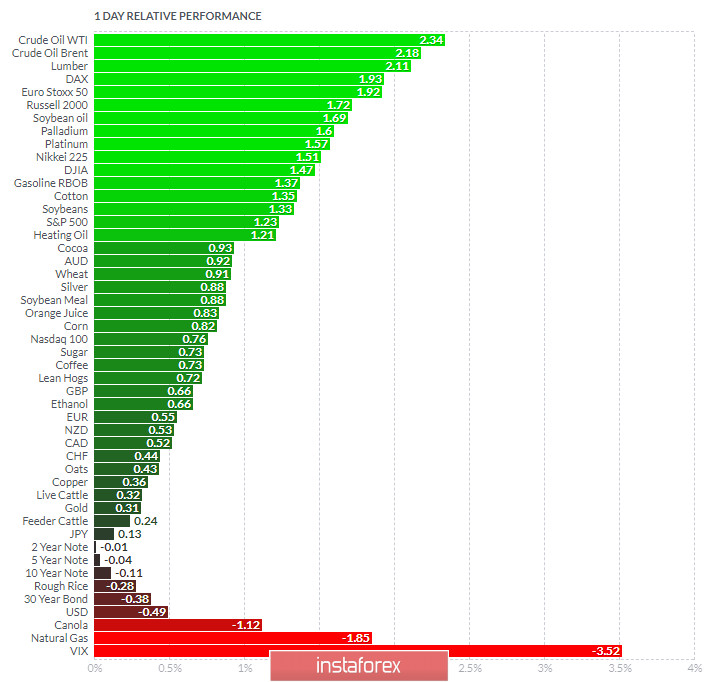

1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Crude Oil and Lumber today and on the bottom VIX and Natural Gas.

EUR is positive on the relative strength list but it is overxtended to the upside and overbought.

Key Levels:

Resistance: 1,1876

Support levels: 1,1600

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română